Since he became leader of the ALP, Kevin Rudd has often talked about receiving a “whack in the polls”; today the whack finally arrived and it was a big one. In two party preferred terms the ALP went from leading 54-46, to being behind 49-51. This drop of 5% was courtesy of an 8% drop in the ALP primary vote going from 43% to 35%! These figures are, to say the least, amazing. For ALP supporters they would be troubling – has the sky fallen in?? Is the dream over??

Well no.

This fall was not entirely unexpected. The trend of polls in the last 2 weeks (if you can have a trend in two weeks) has been against the ALP. The reasons are obvious: they dumped the huge election commitment to build 260 childcare centres, the same day they cancelled the home insulation scheme, then they dumped the ETS till 2013, and then they also raised the price of smokes by 25%.

In one fortnight, the ALP broke wind in the faces of the electorate. And get this, they didn’t like it! The shock!

The big movement in the polls was really Kevin Rudd’s personal ratings. His Satisfaction rating fell a jaw dropping 11% from 50% to 39%, and his Dissatisfaction rating went up 9% from 41% to 50%. This is a huge shift, and demonstrates that the voters were blaming Rudd completely for the decisions of the last fortnight.

But here’s the thing, it’s not that bad a poll for the ALP. Why not? Because while Rudd’s Satisfaction fell, so too did Abbott’s – ok only 1% (which is statistically nothing), but his Dissatisfaction rating also increased – by 3% to 43%. In other words, the voters might be having a massive lover’s tiff with Rudd, but they aren’t about to go off and have an affair with Abbott.

This is also reflected in the 2 Party Preferred vote. The ALP’s primary vote dropped 8% (as Possum at Crikey notes, only the fourth time since 1990 that there has been such a big drop), and yet only 3% went to the LNP (2%, would you believe, to the National Party). Where did the rest go? To the Greens? Err nope – they didn’t change at all. Five percent went to “others”.

Now normally “others” means a mixture of Family First, One Nation rejects, Democrats hangers on and assorted ‘dunnos’. As a result, going by the 2007 election, Newspoll allocates the preferences from the ‘others’ group to the ALP and the LNP on a near 50-50 split (perhaps even a bit towards the LNP – say 55-45) Now the “others” normally accounts for 5-6%, but in this poll it accounts for 12%. Obviously this is not going to happen at the next election.

So who were these 5%? Well I think you can make a pretty strong case that they are ALP voters who were pissed off at Rudd but who sure as hell didn’t want to vote for Abbott, and so instead did a protest vote and said “others”.

The thing is Newspoll is counting them as though they are the normal 5-6% of ‘Others’ voters, when it is pretty obvious they are not. This allows us to have another look at the two party preferred figure, and do some messing around with the numbers (don’t panic, I have a degree in Economics, so I am legally allowed to do whatever I like with statistics to make them mean what I want them to mean).

So we have an ALP primary of 35%. The Greens are on 10%. Lets give 8 of those 10 to the ALP on preferences. That gets us to 43%.

Now the last Newspoll had 7 others. Lets give half to the ALP – that puts it up to 46.5%.

Then we have the added 5% who obviously would end up with the ALP (because let’s be honest if they wanted to vote for the Liberal Party they would have gone to the Libs like the other 3% did). That brings the ALP’s 2 Party Preferred up to 51.5%. Hey let’s be generous and round it down, and we’re left with an ALP 51- LNP 49 result.

See it’s easy!

But I’m not going to say this poll isn’t significant. It is, if only because it puts the LNP in front for the first time. But such a big drop is a good sign of a poll that has perhaps overcooked things a bit. I have no doubt the ALP (and Kevin Rudd) has taken a hit, but to the point where Abbott and the LNP are in front? I don’t think so. And from the commentary of Dennis Shanahan, even he doesn’t think so.

But that doesn’t mean the ALP shouldn’t be worried. Its strategy obviously was to throw out the garbage now and hope the stench cleared by the election. Well it certainly has stunk up the joint now, the test will be to see how the polls react over the next few weeks – especially after the budget. The obvious point I think is the electorate want Rudd to bloody well lead. And to lead now!

The big concern for the Liberal Party will be how few voters from the ALP came over to their side. The big problem for Abbott is that while is it partly true that oppositions don’t win elections, Government’s lose them; the reality is people still want the opposition to try and win them – ie they want to see some decent policies. Thus far Abbott’s policies haven’t exactly had people dancing in the streets.

The other interesting thing about this poll will be to see whether or not this starts the media actually treating Abbott as an alternative PM. Thus far they have been treating him like an opposition leader in the 2nd year of a Govt – ie all he needs to do is oppose, polices aren't important. By this time in 2007 Rudd was being put under a bloody big microscope by the media, and any gaffes or policy stumbles were seized upon. It will be nice to see the media give Abbott some policy microscope work as well…

***

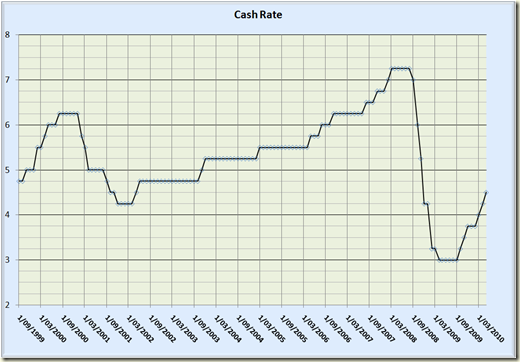

The Board expects that, as a result of today’s decision, rates for most borrowers will be around average levels. This represents a significant adjustment from the very expansionary settings reached a year ago.

The Board will continue to assess prospects for demand and inflation, and set monetary policy as needed to achieve an average inflation rate of 2–3 per cent over time.

What this really means is that the pressure is now squarely on the Government to ease any inflationary pressures. And it starts with next week's Budget. During 2007 the ALP quite rightly talked about the warning the RBA gave the Howard Government about inflation. It’s now the ALP turn to be the ones who will be getting the warnings. This statement by Stevens essentially says, they’re back to normal. They’ll raise interest rate to keep inflation steady and low, but they’re not worried about employment and recession – their work on that score is essentially over.

So we’re back to inflation genie wanting to come out (it obviously isn’t yet), but Swan needs to keep it in mind – because like it or not, he’ll wear the increases from now on. (Isn’t Government fun?)

***

Don’t you just love the mining industry? And I say that as a shareholder of BHP. Since the Government announced the Super Profits Tax on mining, the mining companies have come out saying the Government has killed the mining industry in this country. My initial thought is why worry – after all surely the end of Work Choices killed it – because, as Bernard Keane pointed out in today’s Crikey email, back in 2006-07 the industry and much of the right wing media predicted the end of Work Choices would be the death of the industry. Strangely it seems to have survived that event – in fact apparently it’s booming again!

Today the Chairman of Cape Lambert Resources, Tony Sage, went on ABC Radio and said:

I've made the decision now: I'm ceasing all drilling work in Western Australia that we were planning to do later this year in one of my mines up in the Pilbara. We don't know and understand exactly how it's going to work. While there's uncertainly, I think you'll see many exploration and mining companies cease projects until there is certainty.

You see, they’ve decided not to do something that apparently they were planning to do later this year. I tried to find some announcement that they were going to do this exploratory drilling later this year, but I couldn’t find any. I guess they were keeping it secret and were going to spring it on us later – you know as a surprise party to celebrate 2 years of the end of WorkChoices not killing the mining industry. So I suppose we have to take Sage at his word. After all it’s not like he has anything to gain from getting the Government to back down on introducing the tax has he?

I had a quick Google search on the Cape Lambert South project. If found no mention of exploration in 2010, though I did find plenty referring to proposed exploration in 2008 after it got an exploration licence.

I also found lots of mention of the company’s mines in Sierra Leone – including an intriguing one about welcoming an upgrade of rail and port infrastructure at Marampa in Sierra Leone, West Africa, where the company has an iron ore project.

Here’s the thing about the mining companies – they love to compare Australia to places in the third world where they also do business (and the Liberal Party climb on board this wagon as well) but they never like to talk about the infrastructure, skilled workforce and stable Government that we have here – apparently such thing are free benefits. And yeah, maybe there is lots of stuff to mine in Sierra Leone, but if keeping the miners here means we get to enjoy the economic wealth the same way that country does and reap the benefits with a per-capita GDP of $759, that has them ranked 174th out of 181 countries, I say they can get stuffed.

Tax ‘em.

Is the Super Profits Tax anti-inflationary?

ReplyDeleteGrog

ReplyDeleteAnother aspect of the Cape Lambert commentary that is interesting is that the statement was made on ABC Radio, rather than an ASX announcement that would otherwise be required for a *material* piece of information under a company's continuous disclosure obligations (are I say, particularly a company with a live bidder's statement in the market). Very unusual.

Anon,

ReplyDeleteYeah I wondered about that as well.

Zac Spitzer - the Super-profits tax will have no impact on inflation. It's not like a tax on energy or on other consumables. It is a tax on the profits made by a company, not on its product or its inputs. ie - the cost of what they're doing doesn't actually increase, nor does the price of what it sells.

What will be affected is the amount of money that (some) companies make in profits (after they have paid the tax - not before).

Some will argue this will make production less beneficial for companies and thus they'll stop doing it here and go elsewhere - but that is an employment impact, not an inflationary one.

While there's uncertainly, I think you'll see many exploration and mining companies cease projects until there is certainty.

ReplyDeleteTerrible news! This insane "super tax" will hurt struggling families and result in minerals being wastefully left in the ground for future generations. Where are all the under-30s supposed to go when Tony Abbott cuts off their Newstart allowance?

Also, Grog, I'm disappointed that you didn't seriously engage with any of the valuable contributions Steve Fielding has made to this debate.

Totally agree with your treatment of that amazing "others" figure. Obviously ALP voters mad with Rudd - and the Greens, but totally unimpressed with Abbott's idiocies.

ReplyDeleteDid you also find the 66% increase in the NP vote a bit suss - or is their vote so miniscule that the whole lot almosts falls in the sampling error range?

And L, I should have also mentioned that Fielding believed this poll showed people were flocking to Family First.

ReplyDeleteAh geez, I'lll almost miss him.

Almost.

Agnes - I did think the increase the Nats vote rather suss. A 2% increase in the Libs and a 1% increase in the Nats would have made a bit more sense.

ReplyDeleteThough for the life of me I can't think of one thing the Nats did in the last fortnight that would have had anyone switching their vote from the ALP to them.

And L, I should have also mentioned that Fielding believed this poll showed people were flocking to Family First.

ReplyDeleteI know that my first thought on hearing that the government was planning to impose a resource rent tax on mining projects was the threat this poses to the values of the traditional Christian family, and my second thought was "only a man dressed in a giant bottle costume can solve this problem".

Grog,

ReplyDeleteYou are probably aware of it, but I'll say it again, Clive Palmer, the LNP's bankroller in Qld., and all-round fat bastard, also came out in the media and said that HE was going to can 2 projects now. One in WA, and the other in SA. David Crowe was on NewsRadio this am and said exactly the same thing you did about Cape Lambert...no announcement to the Stock Exchange, no previous knowledge of the projects, announcement direct to the media. Smells very fishy to me. Probably has something to do with that meeting Mr Abbott had with the Mining Industry nabobs when he was in Perth recently setting up that other spoiler group against the government's new Population Ministry and policy stance. God that man Abbott is a devious bastard. He, and his fellow travellers, are playing hardball and they are playing to win. I just hope the PM has something up HIS sleeve to counter them.

Hillbilly,

ReplyDeleteWhat Rudd has up his sleeve is that Australia has a shirt load of stuff in the ground that in the end the mining companies all want.

My bet as well is Australian voters are not going to be impressed by Clive Palmer types saying, "Well bugger it, we'll go off to some third world country and do to it what we like".

And given what they did after their scare mongering about the end of Work Choices, it is an empty threat.

Grog,

ReplyDeleteBut, but, but, but, but, the fat bastards of the Mining Industry always use the little guy as their pawns, referring to the x number of thousands of jobs that will be lost when these projects are shelved. Which always titillates the bloodhounds in the media, eager for an angle.

And it looks like Leigh Sales has fallen for the bait, hook, line and sinker. She couldn't wait to mention Cape Lambert on Lateline.

ReplyDeleteQue? Ian Macfarlane feels ashamed to be Australian due to a government that discourages foreign mining companies?

ReplyDelete