Today over in Perth Julia Gillard held a press conference to talk about jobs.

About bloody time.

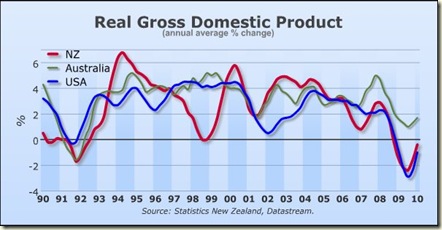

I’m not sure if you know it, but Australia got through this thing called the Global Financial Crisis without going into a recession. I’m not sure if you’re aware but interest rates at the moment are lower than in 2004 when John Howard bragged about keeping them at record lows. I’m not sure if you’re aware but at the moment inflation is well within the Reserve Bank’s 2-3% band.

If you’re not aware of those, send a message to those advising Julia Gillard and those running the ALP campaign and say “Oi!!! Talk about the bloody economy!!!”.

The problem with the ALP’s campaign is not the leaks. I mean yes they are a bloody problem, but if the best they can now get is the one on the front page of The Oz, I think they’ll be ok. It screamed “beat-up” as soon as Alexander Downer was brought in for a quote. However Julia still had to deal with it in her press conference, and then of course had to deal with being asked if it was frustrating to deal with such questions (sigh). But still that’s life, she hit the issue out of the park (though I doubt that’s how it’ll be reported) . The problem with the ALP campaign is not the removal of Rudd. I mean yes that is a bloody problem and at the time I thought it a terrible mistake.

No to discover the problem to the ALP’s campaign you have to go back to November 2008. The ALP just seen the abyss on the horizon and had thrown out a stimulus package. In hindsight it was shown to be a brilliant move. At the time most economists were saying the same thing. Some wanted tax rate cuts, but most thought the cash bonuses were the way to go. Except Kevin Rudd and Wayne Swann were actually embarrassed about them.

They wanted to talk about stimulus but not the reality of stimulus. Remember this stupidity on the 7:30 Report:

KERRY O'BRIEN: So let me hear in plain English, that the Budget is within a hair's breadth of going into deficit. It seems silly to me that anybody would bother to argue that proposition. Will you accept going into deficit, if you have to, to maintain appropriate stimulus of the economy under the threat of recession and high unemployment?

WAYNE SWAN: Kerry, it would be silly to speculate along the lines of your question?

KERRY O'BRIEN: Why?

WAYNE SWAN: Because I've made it clear. We are projecting modest growth and modest surpluses but if the situation were to deteriorate significantly it would have an impact on our surpluses and it may well be the case that we could end up in the area that you're speculating about.

KERRY O'BRIEN: Well, say it. In deficit.

WAYNE SWAN: I am not going to say it because we're projecting modest surpluses Kerry.

And then remember Wayne Swan in the 2009 Budget not even saying “deficit”?

Madness. And it is costing them now.

The reason is back then they should not have been scared about the deficit, they should instead have been proud. They weren’t going into deficit because they couldn't manage the economy; they were going into recession to save it! They got so spooked by what the Libs might do if the budget went into deficit that they ensured the Libs would be able to attack them on the deficit – because the action and words of Rudd and Swan made it seem like deficit was this horrible economic condition which must dare not speak its name.

And so we have the Libs convincing everyone that deficits are bad. They’re not.

The Libs have everyone convinced that a deficit means the Government is living beyond its means. It does not.

The Libs are also trying to convince everyone that just because you’re in deficit it means you can’t spend money on certain things. It does not.

Now I’m not sure who was advising Rudd and Swan, I’m sure they were all smart folk – after all Rudd’s economic whizz Andrew Charlton was a Rhode’s Scholar and I am nought but the lone Keynesian in the Flinders-Adelaide Uni Economic Honours Class of 93 – but how is it none of them could explain a deficit so people who do not study economics could understand?

Did anyone compare it to a house mortgage? Did anyone try and say going into deficit to stimulate the economy and save jobs during the GFC essentially was like a parent whose son has lost his job and who needs a roof for his family to stay under for a while. So the parents build an extra room for his son’s family and to do so takes out a small loan against their house. The parents wish they didn’t have to do it, but do you think they are going to stand by and let their son and grandkids be out on the street just because they didn’t want to have mortgage repayments? Of course not.

The stimulus wasn’t done just for larks; it was an emergency. Arguing against it should be like arguing against emptying a pool to help put out a fire because you don’t want to use the water. Madness.

And as for the total figure? Who cares, really. Sure you don’t want it too big but even at the greatest it was predicted to be about 14% of GDP. Pfft. Did anyone say to the Australian people that the average home loan is around $400,000. Do you think people with that loan go around worried because they are $400,000 in debt? Of course not. What they worry about is whether or not they can make the mortgage payments. And Australia can afford to make its repayments. How do we know? Well the debt was forecast to be $315b. Now it is forecast to be $57b. If we couldn't afford it, it would be growing not shrinking.

We may have a structural deficit but that’s another debate for another time – and Howard and Costello have much to blame for that…

You see a deficit is just a home loan. You may own a home but if you want to build on, or maybe put up a pergola to make the house better – ie increase its value – then you’ll take a loan against the house to do so, and that’s ok – so long as you can afford the repayments. The Libs would have you believe the current budget situation is like someone paying off their MasterCard with their Visa Card.

The only problem with a deficit is if you are doing so when the economy is ticking along nicely. Do that and it’ll be inflationary. However even being in deficit is not a mortal sin in such cases IF the things you are spending money on that puts the budget into deficit are not inflationary – ie infrastructure (you know that thing the Howard Govt thought states should worry about). Things that are inflationary are middle class welfare policies – you know things like giving people who earn $150,000 a year or more $75,000 when they have a baby…

If the Rudd Govt had been more proud about the deficit and actually explained it to people – in terms we could all understand – then all this bull about paying off the debt would be gone. Hockey for example wants to sell Medibank Private. Why does he? Not for efficiency reasons. No he just wants to sell it to pay off the debt. Why?? If you can afford your mortgage repayments do you sell your car so that your overall mortgage is less? No of course you don’t – unless you are stupid enough to employ Joe Hockey as you financial advisor.

All these things should be the focus of the Government. They need to embrace their stimulus, embrace the GFC and what they did.

Were I in charge (yeah yeah, I know) Moving Forward would not have been the slogan it would have been

Let’s Keep Working

There would be adverts like:

During the Global Financial Crisis the following countries went into recession:

United Kingdom

Japan

New Zealand

Germany

Russia

Italy

Hong Kong

Singapore

Ireland

Greece

Spain

Sweden

Ukraine

Iceland

Estonia

The United States of America

The countries that didn’t:

Australia

VOTE LABOR and LET’S KEEP WORKING

Who cares that France, China and Canada didn’t go into recession, if the Libs want to point that out, go for it. Or how about:

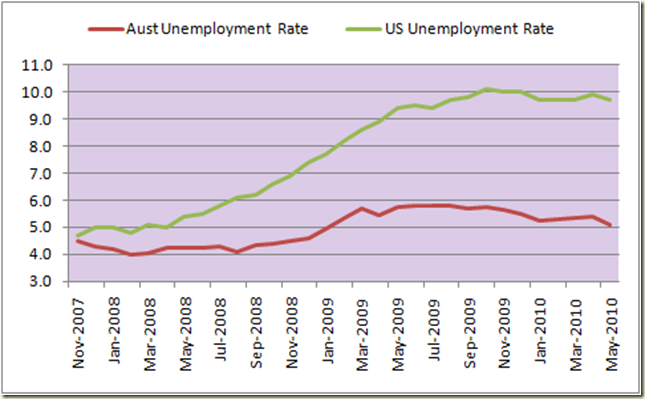

The unemployment rate in

New Zealand is 6 percent

Germany is 7 percent

Brazil is 7.3 percent

Czech Republic is 7.5 percent

United Kingdom is 7.8 percent

Canada is 7.9 percent

Italy is 8.9 percent

Russia is 9.2 percent

Sweden is 9.5 percent

The United States of America is is 9.5 percent

France is 10.1 percent

Spain is 20.1 percent

The unemployment rate in

Australia is 5.1 percent

VOTE LABOR and LET’S KEEP WORKING

Or then there’s:

In November 2007 the official interest rate was 6.75%

In August 2010 the official interest rate is 4.5%

That will save you $568* a month

VOTE LABOR and LET’S KEEP WORKING

Then there’s the NBN:

Labor wants to build a National Broadband Network that will

Provide super fast broadband coverage to 93 percent of Australia

That will improve small businesses

Improve the provision of health for all Australians

Improve education possibilities

And create 25,000 jobs

Tony Abbott wants to scrap it

Sorry Tony

LET’S KEEP WORKING

VOTE LABOR

In February this year Tony Abbott says we should be like New Zealand

During the Global Financial Crisis:

New Zealand’s unemployment rate reached 7.3%

Australia's unemployment rate reached 5.8%

New Zealand went into recession

Australia did not

Sorry Tony, but LET’S KEEP WORKING

VOTE LABOR

Or if in doubt show them this graph:

The polls out today with the LNP ahead 52-48 should be a wake up for Labor. They’re not gone yet, not by a long way.

But they need to sell their message better and they need to focus on what they did right.

By all measures Australia has achieved "full employment" during the GFC.

ReplyDeleteDoes it get any better? I cannot imagine how it could.

This is the message. We, through polite but firm, fiscal management gave the slip to the worlds economic ills and stand proud as the world's best economic managers.

Upon this rock we stand. Let those that want to take it down try their hardest.

From this most wonderful starting point, Australia can start to fix our social ills by spending money.

We should not cower, nor measure ourselves by international comparisons. We brained it.

Now lets "Move Forward"

Great post Grogs

great post and I completely agree with you. How the media continue to let this slide is beyond me - Labor needs own the topic of the economy and how Australia lead by an ALP government weathered the GFC storm vs. other nations; pushing out the hard numbers to drown out this BER and Insultation waste line the coalition has be running with!

ReplyDeleteThomas

Another quality piece, Grog. Surely the key to any election campaign is defining the parameters of the campaign. Howard was a master of it, Rudd effectively countered it, but the ALP are allowing the Coalition (and the conservative press) to dictate the parameters of political discourse this campaign.

ReplyDeleteThe ALP have created 'Abbott: The Prime Minister'. Unbelievable.

Ross Gittens has been arguing much the same reasoning in the SMH for most of the last year.

ReplyDeleteHope if enough people explain it in different places, it might start to get the message across.

I think you have again managed to highlight just how badly the ALP has run its campaign. The years of Howard & Costello whining about scary deficits whilst failing to build any infrastructure was just a Menzian waste of resources returns.

ReplyDeleteThe deeply frightening thing is that innummeracy now seems to be the norm and potential treasurers and the average member of the press pack is happy to prognosticate on numbers they can't add up

Hi Grog, another great article. Did you see the great veteran Laurie Oakes' piece today in the Herald Sun titled "PM must stress economic health" ?? He is basically saying that the Labor govt. has managed the economy well. Is that to show balance I wonder? Pity he's not printed nationwide. Funny you should mention the longest serving Foreign Minister. In the Oz today "Body guard deputised for Gillard", Downer has a bit to say. The really interesting bit was about the "body guard, junior adviser" to Ms Gillard. Quote, "Mr. [Andrew] Stark, a former Liberal Party member, worked for Mr. Downer as a body guard and security official when the latter was foreign minister. He was later hired as a body guard and security official for Ms Gillard after the Rudd govt. was elected in 2007, and subsequently became a junior adviser in her office". We have been asking ourselvess who stands to gain the most from the leaks. Labor ?? apparently not at present at least. The Coalition?? certainly at present. Laurie Oakes told Julia Gillard to "look much closer to home" and the press gang automatically leapty leapt on Kevin Rudd. I might be alone in believing it's not him and quite possibly anyone in Labor ranks. Not long before the Scores scandal broke, Downer, in Parlt. spoke directly behind J. Howard and of course the microphone picked up. He said if we knew what he knew about Kevin Rudd.....and kept walking. Tricky bugger, he has many connections. These are just my observations of course.

ReplyDeleteSome good observations Anon.

ReplyDeleteYep Oakes's piece was excellent (I linked to it yesterday).

Today's Oz story did not smell like the previous "leaks". That's 2 leaks about the NSC now. Both seem like beat ups. And both were far less damaging than the Oakes' leak - which may be because Oakes's stories have more influence on the rest of the media than what The Oz decides is news.

You are such a clever little cookie.

ReplyDeleteYou are spot on with this post ofcourse. Spot on.

I can't remember who said this, but I read a comment back around the announcement of the RSPT that said the problem with Labor isn't the policies, the problem is that they couldn't sell a cold beer in the Simpson desert.

ReplyDeleteBill - Yep I remember that comment - can't recall who said it, but they were spot on. Sigh

ReplyDeleteHi Grog.

ReplyDeleteI am a lifetime Labor voter and agree with most of what you say.

I am in complete agreement that the government should be proud of it's deficit and of the avoidance of recession and the relatively low unemployment that have flowed from it as a result.

However, I am constantly dismayed at the meme seemingly unshakably entrenched in the public mindset that government debt and deficit are bad by their very nature. There is little or no understanding of what government budget deficit actually is, how it arises, what part it plays in the interaction between the different sectors of the economy and what the implications are. Simply the unquestioned assumption that it is bad for everyone (and a surplus by implication, must necessarily be good). It must be true because everybody else seems to think it is. It's a pure prejudice.

Logically, it should be almost impossible that a government who is going to the polls with the distinction of being one of the only advanced countries to have avoided recession, and with relatively low unemployment, low interest rates and inflation within the target band and falling - that such a government is still widely regarded as second-rate economic managers compared to the other side.

I think this demonstrates just how deeply conditioned certain beliefs are within the public phyche.

Which explains Labor appearing sorry for being in deficit - the existence of which is largely out of the control of government anyway - and promising to get back to surplus post haste. The manner in which I personally understand our modern economy to function make me sceptical that to attempt such a thing is wise or even possible to achieve any time soon.

But that aside, my question is: how does a government sell a deficit to the voters? How is it possible to change such deeply held beliefs?

Anon they do it by doing what I wrote - make it understandable - most poeple have a mortgage, so explain it in those terms.

ReplyDeleteWe can afford the repayments, we're paying off the loan ahead of time. We're actually doing very well.

They should make the point - if you had taken out a home loan and you were going to be able to pay it off in half the time it was expected that would be a pretty good sign that you were able to manage your finances. Well that's the situation of the Govt. If our home loans were in as good as shape as the Govt's deficit we'd be laughing with joy.

I agree with how the ALP's addiction to neoliberal ideology around public deficits has hampered its ability to sell the positive effects of the stimulus (although we were very lucky we're a medium-sized economy that could also ride the coattails of China's boom/stimulus).

ReplyDeleteBut we have to ask why, with all this good economic management, ordinary punters are grumpy with politicians. It reminds me of Howard and Keating just before they got booted out, telling people they've never had it so good, and quoting stats much as you do. Remember Keating's "beautiful set of numbers"?

Today's Fairfax papers provide a clue: http://www.smh.com.au/national/a-hardworking-nation-thats-losing-its-balance-20100731-110kx.html

Behind the headline economic success has been a very unequal distribution of economic sunshine. Since the crisis of the 1970s ended the long postwar boom, economic recovery has been based on a neoliberal program that has actually made most people's lives worse.

I think Rudd rode hope for a better society to get into office. Beyond some very important symbolic gains (e.g the apology), that improvement didn't come and the big picture issues like climate change got trashed. People rightly wonder what better future the ALP can deliver... and the party's inability to project a coherent vision into which some of its small-picture reforms fit makes it worse.

I write more on this here (shameless plug): http://left-flank.blogspot.com/2010/07/flight-from-centre.html

Grog,

ReplyDeleteIn your post, you wrote

"...they should not have been scared about the deficit, they should instead have been proud."

Of course! And the thing is - that for a Party that generally accords great value to Education, dear said Party seems remarkably inept as Educator. Often this brute fact is represented by saying that they can't "sell" anything.

This representation may be true, but it is not on the mark. For 'selling' is not what is required. Not any more.

Education is required instead.

Your Comment (above) that: "...they [should] do it by doing what I wrote - make it understandable - most people have a mortgage, so explain it in those terms" [etc.] is spot on.

I know the people in the government believed in the worth and the rationality of what they did. But sometimes they don't quite act that way after their deed is done. They need to learn to articulate the reasons for their actions, to put said reasons out there, to back their reasons up with further explanation, elucidation, clarification, and - if needs be - to show the inadequacy of any response.

In short, they need to own who they are.

its @BernardK

ReplyDeleteAnother great post here today Grog.

I'm loathe to enter into a conversation when others are probably better positioned to make the pithy observations, but one thing that also needs to be mentioned is that Aus has a tragically low level of sovereign debt for the banks to be able to hold as security.

BIS capital requirements are being changed almost specifically for Australian banks to reflect that Aus banks do not have access to Aus govt AAA securities to hold as capital security.

This was one of the reasons that credit derivative instruments were looking like a good idea (and in the case of most Aus banks were actually used as sensible capital / portfolio management instruments) in the late 90's and beginning of the '00's.

Under Howard, the prev debt was paid back way ahead of what was healthy for the financial and capital markets, and then the surpluses were squandered on useless tax cuts, rather than used in conjunction with debt raising for decent infrastructure.

We can probably thank Howard to some extent that Labour did inherit such small debt that it was able to raise as much as was required up front for stimulus, but hell. We could have been so much further ahead if debt and prior surpluses were invested in the long term future of the country, rather than tax cuts.

It's not smagic - unlike the security word verification I now need to enter!

Keep up the good work mate.

Great Post Grog.

ReplyDeleteThis stuff is basic. In opposition you are so starved of attention that you're condemned to the reactiveness of the spin doctors. When in government you control the agenda. And the best way to control it is to tell large simple truths. Slipping and sliding away on the 24 hour news cycle, you end up completely disoriented in no time yourself, let alone the electorate.

Yep Nicholas - people actually do understand economics, but you have to put it in everyday terms or they'll switch off (because oddly not all of us actually like economic theory!)

ReplyDeleteIt gets a bit screwy when you start talking about comparative advantage and some such. But a deficit or surplus? Geez, that's easy.

You've hit right on what frustrates me with Labor - they have made some amazing achievements but are failing to cut through. And it's not even a complex message in many cases, but they tie it up in stupid language that makes it too hard and the average (non wonky) punter turns off the TV.

ReplyDeleteSo many of their ads seem to be negative, and they could be putting some time and effort into this stuff.

The Sussex St geniuses strike again.

ReplyDelete"Oh no, we can't admit to a D-E-F-I-C-T. The punters are too stupid to understand that the surplus is there for a reason. And we have a shitstorm brewing offshore."

Exactly anon. What really annoys me is if Rudd and Swan had owned this and sold it properly it would have changed the way poeple would have viewed Govt finances. But because they were too scared, we are still ruled by Costello and Howard's myopic view.

ReplyDeleteUtter shame.

Grogs,

ReplyDeleteWhat are you saying about interest rates?

Our interest rates fell because of global conditions and the economy cavitating, Chinese demand for our resources picked up late 2008, now ther're headed back up.

Australias Employment rate has plumented,

21% of people 25-54 are unemployed.

it was 14% in 2009.

25% of workers are part time.

Thats Labor policy for you, waste and lies.

I might've mentioned this on twitter but i think you're spot on when you identify the problems for Labor being seeded at the end of 2008. To be fair to them they were probably shitting themselves at the prospect of unemployment hitting 8-10% but even at the time it was clear that they could only maintain their strategy by looking stupid.

ReplyDeleteRemember all the times ministers refused to say key words like debt and deficit, willing to wear the media making them look like fools by highlighting their reluctance, just so long as they weren't the first to say it.

Their credibility issues from dumping the ETS are in some respects, an amplified version of the same thing. To quote Rudd in 2007, in a very different context, they were "too cute by half."

Anon unemployment is 5.1%, you can split it up anyway you like it, but that's the figure.

ReplyDeleteAnd yes interest rates are lower now because of the GFC - (can I get a "well duh!"). But they are still 2.25% lower than Nov 2007 - if you want to say interest rates are low because of the GFC, well then I say unemployment is higher now than then because of the GFC.

Abbott and Hockey would have us believe the GFC never happened, am glad you realise it did.

@ Anon 10:17pm

ReplyDeleteOn the one hand, you imply low interest rates are due to external factors, and on the other, that employment rates are due to internal factors. As interest rates and employment (amongst other things) are economically inter-related, the government either gets the blame and praise for both or for neither. You can't have it both ways.

(BTW, do you mean underemployment rather than unemployment?)

@ Grog, why aren't you in advertising? Brilliant!!

Cheers,

Ro

A couple of observations:

ReplyDeleteLabor's faith in its power to persuade took a dreadful hit with the Whitlam experience. Even in the Hawke-Keating period the determination to not be the "Whitlam Government disaster" was a primary motivation for playing the game according to neo-con rules, Keating's admirable efforts notwithstanding.

However, Labor's post-1996 capitulation to the Liberals' dissing of Keating meant that the Party completely lost faith in its ability to establish a different narrative about the functioning of the economy. That's the origin of the issues with Swan's deficit problems , which you articulate so clearly.

A (trivial) suggested modification of your proposed ad about interest rates: make the comparison between the standard variable home loan rate rather than the Reserve Bank figure. That's the one people actually pay, and they will quickly recognise that it's lower than it was three years ago.

They must have heard you Grog. Look at this ad.

ReplyDeletehttp://www.youtube.com/watch?v=jmGeSxDnx74