My Drum piece today is on consumer confidence and whether or not it is as important as we suppose.

It is a damn hard thing to demonstrate correlation between it and economic growth, though I’m sure it can be done – with varying degrees of confidence and holding various assumptions.

I try to avoid too much regression analysis – though it certainly has its place, and just like looking at graphs and seeing what picture is told. Personally rather than look at “confidence” I’d rather more time is spent looking at a variety of measures (including non-economic) such as occurs with the OPEC Better Life Index. Also we can always have a look at the good old “Misery Index” which adds the unemployment rate and inflation rates together (a lower score means less ‘misery’):

Here, by comparison, is the Westpac Melbourne Institute Consumer Confidence Index over the same period:

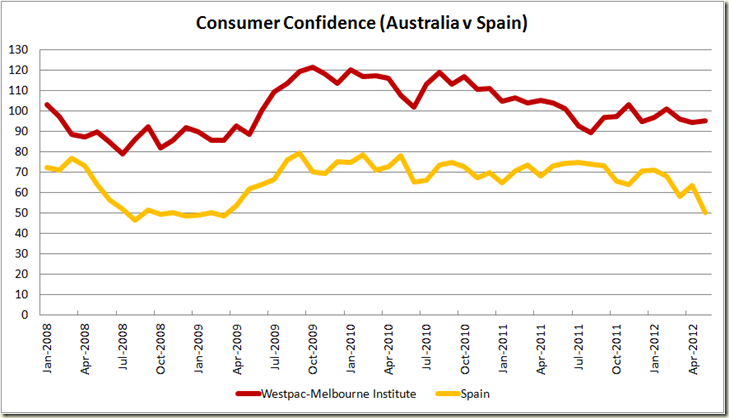

And together:

Which perhaps suggests, we’re more confident about our misery now…

Anyhow here are the graphs:

Here’s a similar graph looking at a few more countries:

Ben Munday :

ReplyDelete23 May 2012 3:18:27pm

It's all about uncertainty and fear - the former breeds the latter. The uncertainty comes from failure of trust, whose source is manifold. I could draw up a long list of things about which we used to have a sense of certainty and thus trust, which reduced our fears of the unknown. For starters:

- falling or flat house prices;

- growing cost of energy and utilities;

- fluctuations in interest rates and refusal of the banks to pass on full reductions;

- wobbly superannuation funds, witnessing the devastation of the GFC to retirement plans and overseas economies;

- the feeling of being ripped off by retailers when we see on-line prices;

- doomsday reporting in the media;

- Europe;

- formerly-trusted institutions screwing us, eg Qantas, Telstra, banks;

- fear of being ripped off because of our failure to disentangle jargon, eg understanding and being able to compare mobile phone plans;

- job insecurity and employers calling for more casualisation of employment;

- media obsession with failed business, mass retrenchments;

- the pace of change and the difficulty keeping up;

- the constant barrage of advertising which creates a perceived need to sell a product which will forestall a perceived fear;

and you can add plenty more I'm sure.

I'd bet many people would gladly exchange "competition" in private sector provision of services for a nationalised superannuation/pension fund, nationalised health insurance or a nationalised health service, and a guaranteed bed at a fair non-profit price in nursing homes.

I posted the above on The Drum website. This evening my wife told me that many if not all her work colleagues will be pre-paying their private health insurance now for the coming financial year, then dropping their health insurance because of the withdrawal of the health insurance rebate. We're talking middle-class public servants on $50-80k pa. Most said they were sick of the growing gap in insurance coverage and the uncertainty of the cost of surgery, depending on which doctor provides it. More lack of certainty, lack of trust. All that people want is the feeling they are getting a fair go and not being ripped off.