If there has been one aspect of the debate over superannuation taxes that has become clearer to me as it has gone on is that it is really just the first salvo in the war by vested interest groups, and equally vested media groups for a move to a flat income tax.

We now live in an environment where the suggestion of progressive taxation results in media articles accusing proponents of indulging in class warfare.

The front page of today’s Oz made it clear that superannuation is just the small fry. The bigger game is income tax.

The front page featured an article by Adam Creighton – he who last year called for policy to be less evidence based and more ideology driven (oh and democracy isn’t sustainable either) – which argued against progressive income tax.

The article’s headline gives away its intent:

Wayne Swan's rich targets already pay the bill

Creighton notes in the third paragraph that:

Australia's tax system is highly progressive, with a top marginal tax rate of 45 per cent - above New Zealand's at 33 per cent and the US at 35 per cent.

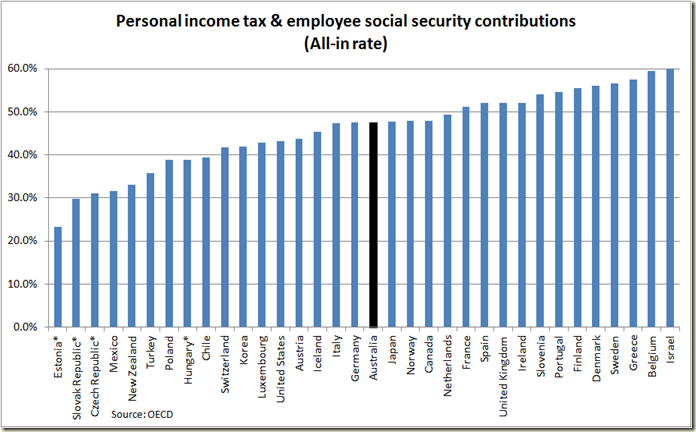

Now that would seem to make us the very epitome of socialism, but Creighton fails to mention a few other countries. Thankfully for us the OECD has the information and we can see that the UK for example has a top tax marginal rate of 50% [Neerav Bhatt on Twitter has reminded me that the Cameron Govt has just reduced this to 45%], Belgium has 50%, Germany has 45%, Israel has 48%, the Netherlands has 52%, and Japan is just below us with a 40% top tax bracket.

Now actually comparing the progressivity of different country's taxation system by looking at what is the top marginal tax rate levied by the central government is actually quite simplistic (borderline stupid, really), especially when you consider if you include (as the OECD does) Personal income tax PLUS employee social security contributions from the central and the “sub-central” (ie state Govts in the USA) then the USA’s top marginal tax rate comes in at 43.2%, and Australia is pretty much right in the middle of the OECD pack.

But as there are much better ways to look at progressivity of tax and I’ll do that another day.

For now let’s keep to flat tax and Creighton’s argument, which he states here:

Overall, the top fifth of taxpaying households are the only net contributors to Australia's welfare state, once handouts and use of government services such as education and healthcare are taken into account. The more you earn the more you pay, and at an increasing rate. A chief executive earning $1 million a year is required to pay more than $423,000 in annual tax, almost 40 times as much tax as a high school teacher earning $60,000 a year.

A junior apprentice pays an average tax rate of a little over 9 per cent compared with 38.3 per cent for the successful barrister.

Now I don’t know about you, but I am not too stunned by the fact that someone earning a million dollars pays a shirt load more tax than a school teacher, but apparently this is news (front page news at that). Indeed get me some feathers and knock me down, because did you know a barrister pays more tax than a junior apprentice?!

!!! (I mean wow!!)

Yes boys and girls, Adam Creighton has discovered that Australia's income tax is …. (get the kids to leave the room, this is pretty shocking stuff) progressive. (The Tele is right, Stalin is in control!)

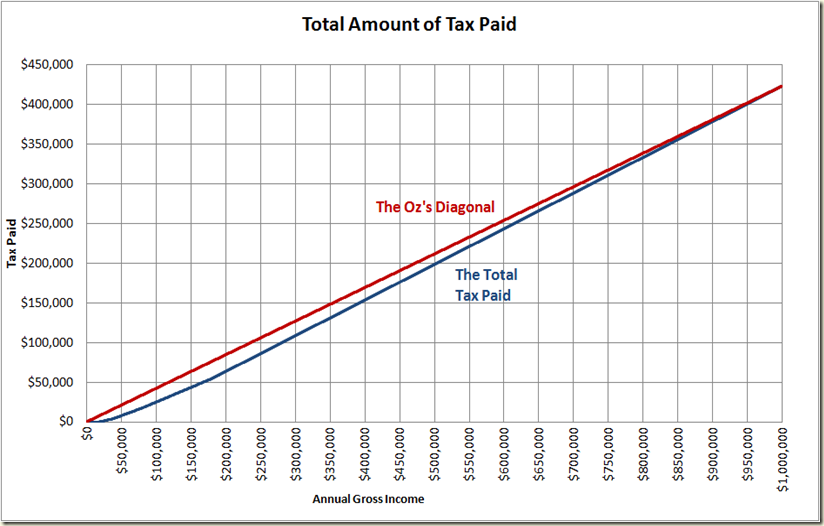

There’s even a handy little graph provided (on the front page) to show us the injustice:

Now a few things about this graph. First. How about that scale! It certainly make for a big bow of progressivity!

But that diagonal red line is the key. That is The Oz letting you know that those teachers, public servants are getting in their view the equivalent of a tax concession!

OK. Let’s get to the graph. Here’s what Creighton’s graph looks like with the correct scale.

Not quite as impressive is it? That’s because the first 4 categories in the Oz’s graph occur in the first three income instalment in the real to scale version.

So OK, they use dodgy graphs to sell their point (beats the hell out of being honest with your readers I guess).

But let’s get down to it. Here’s the current Marginal Tax Rates, and I’ll go to $1m to match Creighton:

But the thing about taxation is just because you are in the marginal tax bracket of 45%, you don;t actually pay 45% of your income in tax, because of course the 45% rate only applies for that part of your income that is above $180,000. So a much better way to look at things is average tax rates:

So as you can see the line goes up fairly steep (as sign of progressivity) and then flattens out. From this you can work out that if say you earn $100,000 you’ll have to pay (before deduction and not including the Medicare levy) around 25% in tax, even though you are in the 37% tax bracket.

Now if we were to apply the logic of The Oz’s flat tax diagonal line, here’s what the average tax rate would look like compared to the current:

As you can see everyone except anyone earning $1m dollars pays more under this flat tax rate of 42.35%

Now maybe The Oz does think everyone should pay more tax, but no one – not even the lobbyists for rich people, says a flat tax should start at zero. There are many good reasons for having a tax free threshold, and other than social reasons, economically it make little sense to tax someone when they earn so little that the tax would actually be a disincentive to work and also would likely encourage cash in hand work.

The current tax free threshold is $18,200. Up till last year it was $6,000. But there is also a low income tax offset, which meant till last year the effective tax free threshold was $16,000, and now is $20,542.

Let’s assume the flat tax folk want to simplify the tax scheme (that’s often the reason given when they want to hide their real reason). So let’s not bother with the low income tax offset, but let’s start our 42.35% flat tax at $18,200, and see what happens to our average tax rates:

Notice anything that happened because of that tax free threshold? Yep. Because it lowers everyone’s average tax rate and because the top marginal tax rate is now 42.35% and not 45% that means those at the higher end actually would pay less tax!

How does that look in terms of difference of total tax paid? Have a look:

Yep, under this flat tax rate everyone who earns less than $707,400 pay more tax, those who earn over pay less.

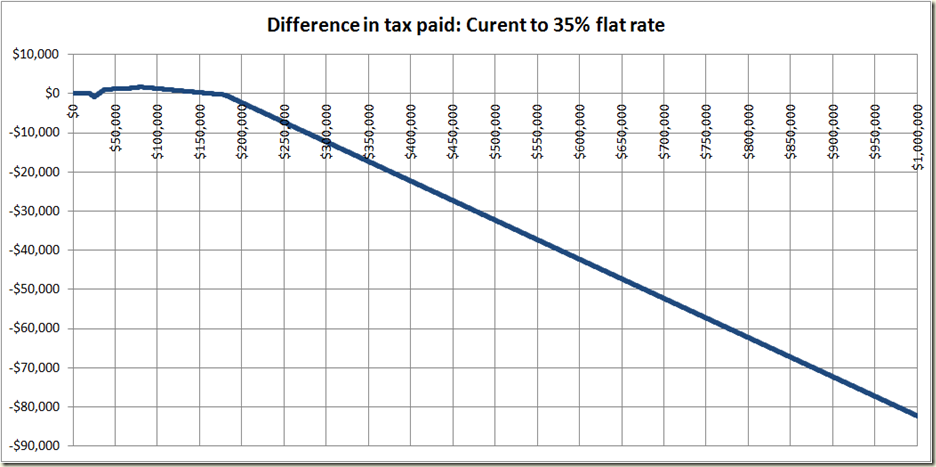

But even the flat tax disciples don’t want this scenario. We only have to go back to Creighton’s article – it is the top marginal tax rate that is the problem. The Henry Tax review called for a flat tax of 35% starting at $25,000 and going to $180,000, at which point the 45% would kick in as usual. And because we’re dealing with real world ideas now, I’ll include in the current average tax rate the impact of the low income tax offset:

As you can see there is not as much change – because the rate isn’t as high, and also because the 45% top tax rate still exists. But some people still need to pay more tax, and some pay a bit less:

Those from $25,000 to around $165,000 pay more, and those after pat $297 less – it stays flat because that top tax rate remains as before. You can see there’s a big decrease in tax for those between the current effective tax free threshold and the $25,000.

But note who is paying the most extra - those earning between $50,000 and $100,000 – ie those pretty much in the median income grades.

Equitable? I think not.

And remember as well that 45% tax rate is still too high under the Henry recommendation. The IPA in its infinite, paid for wisdom, suggests in it’s 75 big ideas that:

“Number 45. Introduce a single rate of income tax with a generous tax-free threshold”.

So let’s put that threshold at $25,000, where the Henry Review suggested and keep the 35% of the Henry review as well, but we’ll remove the 45% rate at $180,000 because the flat taxers only want one tax rate.

Let’s look how that compares:

And now we see the real reason why those who favour flat tax rates are usually those who either are rich, write for newspapers read by the rich, or receive donations from the rich to lobby on behalf of the rich.

So who would pay more or less compared to now?

Kind of stunning ain’t it.

But because looking at things in $ amounts can be misleading, let’s look at the change in tax paid as a percentage of income:

Always remember when someone starts talking to you about how there should be just one flat tax rate for everyone who really will be winning out of the change. Unless you happen to be one of Creighton’s barristers or chief financial officers, it most likely is not going to be you.

Come on Greg, you forgot that if rich people have more money then they create more jobs, or something like that. And people on only $500k will have an incentive to work harder. After all, you are only poor if you are lazy or because the ALP has taken all your money.

ReplyDeleteThe obvious follow up question is - what do we cut to deal with the lower tax intake. After Abbot's comments today, clearly not middle class subsidies.

Good point Chris. I also should have factored in the money all trickling down... :-)

ReplyDeleteAnd yes - that is the other big reason why the flat tax people like a flat tax - it's less overall tax, which means you have to cut down on Govt expenditure to pay for it.

Basically they try an sell it as fair and simple, but their aim is less tax for those on big incomes, and less Govt because that's their ideology

Also remember Gittin's article from last October where he showed that whether you are a net tax payer or recipient depends on your stage of life. Methinks those who whine about others being net tax recipients are probably just greedy old men who are now past that stage in life

ReplyDeletehttp://www.smh.com.au/opinion/politics/stop-grumbling-about-tax-we-all-benefit-along-the-way-20121023-283ag.html

NewsCorp leads the charge of the Whingenation. The richer you are, the more there is to Whinge about. Now that's real progessivity.

ReplyDeleteWombat, I think that is a very good point.

ReplyDeleteI think the IPA have two more ideas to add to the 75:

ReplyDelete76. Abolish public education

77. Re-introduce child labor

Bingo, smaller government,increased productivity and jobs created.

Trifecta

Flat tax rate, flat Earth, whatever.

ReplyDeleteGrog, thanks for quantifying my gut feeling that flat tax rates benefit the wealthy.

ReplyDeleteCan I make a suggestion about redrawing a chart that makes it easier to talk about fairness is addressed in the tax system. Without tax brackets or percentages being involved

ReplyDeleteI can't send you my chart but I can describe it for you

If you go from 0 to $1 million in $10,000 steps you can calculate the tax payable (form your existing tax % chart) and the after tax income (which is income less tax obviously). I know that $10K steps is a lot but the chart is much better for it

Then you have 3 columns in a spreadsheet

1) Total Income

2) After tax income

3) tax paid

You then plot the data using a stacked bar chart with column 1 as the x axis and column 2 stacked onto column 3

You will get a chart that shows the total dollar amount of income (the heigh of the bars is the total income) as well as the after tax income in dollar terms (which is at the bottom of the stacked bar chart) and the dollar amount of tax paid (top of the bar chart.

If you think that higher income earners should pay more tax - then look at the chart - as your income increases the tax paid (top of the stacked bars) increases in almost (but not quite) a straight line proportion. AND as your income increases the amount you take home (bottom of the stack) also increases in a straight line BUT you always take home more than you end up paying in tax

If you think that higher income earners should pay more tax - then what could be fairer than a (more or less) straight proportion.

I think that this (almost) straight line increase in tax paid as your income increases is an easier way to explain how our (progressive) tax system builds in fairness without needing to use percentages of tax brackets (which do more to confuse people than anything else).

You can also make a second chart plotting points up to $200k which shows how the tax free threshold works for low income earners and also that even people on $200k take home the vast majority of their income

I hope I have explained the chart properly and you understand what I am getting at. Hope this helps

John D

This explanation of how a flat tax works is one of the most amateurish I have seen!

ReplyDeleteYou also say that a flat tax requires "cut down on Govt expenditure to pay for it"; you think cutting government expenditure is a bad thing when it is offset by cuts in the marginal tax rates of individuals.

The idea that individuals should accept higher marginal tax rates in the hope that they will have some of their own tax money returned to them via the government through some benefit paid to them is astounding and borderline stupidity. You only have to look at the current overtaxation/welfare churn in which over $200+ billion of benefits are paid directly back to the same taxpayers who paid the tax in the first place; less the governments 20-30% handling fee.

If we reduced the overtaxation/welfare churn we could undertake serious taxation reform and reduce income rates across the board for all income earners.

So, what is the total revenue from income tax? I was reading that there are 12.3 million tax payers in Australia with an average income around $54,000 - is this correct? I cannot help but wonder why if Australia was to consider a flat tax rate it is assumed that flat rate should be a high percentage. Wouldn't it be much fairer to have a flat tax rate of 15%?

ReplyDeleteIt is so hard to work your way up to earning an income around the $100k mark and likely you will never progress hundreds of thousands higher in your life. Once you have worked your butt off to get there you are taxed higher for it, benefits drop, and every man and his dog has their hands out for another piece of your pay.

You don't really gain a huge advantage for all your hard work until you are earning $200k+ which is even more unlikely if you are reaching the $100k level in your prime working years. I can't help but feel that a single income family with 3 kids where the income tips $100k is deemed to be rich when in fact if that same family had both parents working but pulling in only half that amount each then they pay less tax and walk away better off.

A 15% flat tax rate would be fair, encourage people to work hard and achieve more in their working life. Why shouldn't people be entitled to benefit from career progression? The problem is that the tax brackets have not kept up with pay and inflation. Someone earning $80k - $150k a year is not rich, they are not poor but they are not rich. That is comfortable. Earning up to $250k that is wealthy, and earning $500k+ is rich.

But making a simpler, fairer tax system would put a whole bunch of tax agents out of work, a gaggle of public servants making pretty bows with red tape would need to consider a new career, and politicians would not have anything to argue over like spoilt children in Question Time.

Oh, and if there were 12.3 million people earning and average $50k per year taxed at a flat rate of 15% then the government would have $92,250,000,000 to play with each and every year! Seems like a descent amount to me!

No matter who is commenting about flat tax, nobody describes which form of the flat tax their comments are based upon - we all have a distortion to promote.

ReplyDelete