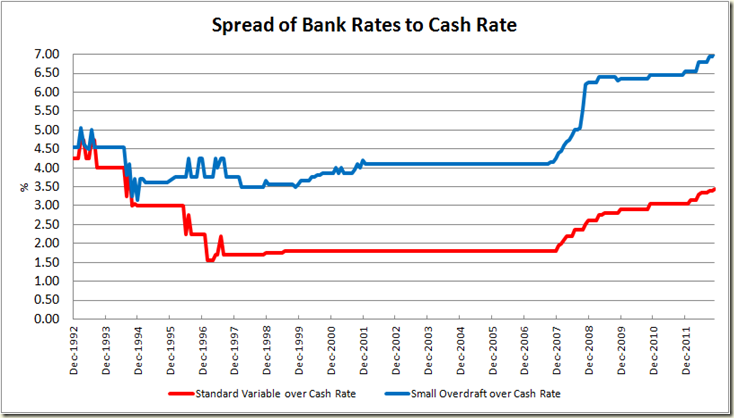

In my monthly round up of stuff to do with the RBA’s interest rate announcement I as a rule show this graph:

Now I must admit that by itself it is a bit misleading. It suggests the banks are making out like bandits, and are screwing mortgage holders royally.

In reality it only tells half of the story.

Today after tweeting a link to the graph, Stephen Koukoulas and Margaret Godfrey quite rightly suggested that I also graph the difference between mortgage rates and deposit rates. That’s a good idea – clearly if the spread of mortgage to deposit rates was increasing then a case could be made that banks are raising rates on mortgage holders (or lowering them by less than the cash rate is declining) while not doing the same for deposit rates. It’s also important because domestic deposits now account for over 50% of banks funding (prior to the GFC it was closer to 40%).

First off let’s compare the spread of 6 months term deposits to the cash rate:

Yes my friends, up until 2008, the rate for a 6 month term deposit was less than the cash rate. Now it is above it. This more than anything is why the first graph shows a bump from 2008 on. Prior to then, banks were laughing with respect to 40%+ of their funding. They were paying you up to 150 basis points less to hold your money than the cash rate. Sweet. But as you can see things started going a bit chaotic as the GFC neared, and then more expensive as the GFC hit. Now banks are paying around 100 basis point more than the cash rate to hold your money.

So obviously they have needed to get that extra money from somewhere….

So now let’s look at the difference between the mortgage rate and the 6 months deposit rate:

The current spread is 250 basis points – the average mortgage rate is 6.45%, the average 6 month term deposit is 3.95%. This spread is currently lower than the 304 basis points average for the term of the Howard Government.

Today when asked what he would do if the banks didn’t pass on the full rate of the cut, Tony Abbott pointedly refused to answer the question (because there’s bugger all he could do) but he said under Peter Costello the banks did what they were told (patent bullshit).

What has happened is that the funding mix has changed, and perhaps surprisingly the gap between what the banks are charging you to lend from them, and what we are charging them to lend from us (which is essentially what a deposit is) has shrunk of late, and at the very least is not much different to what it was when Peter Costello’s hand on the economic tiller. For Tony Abbott to say things would go back to the way they were under Howard and Costello is to suggest that actually not much would change in reality – but given the focus is almost always on mortgage holders rather than deposits (and I admit I am guilty of this as well) it’s an easy sell.

One last thing, let us look at the difference between the two rates – mortgage and deposit – and inflation:

First 6 month term deposits. This gives in essence the real return on your deposit. If the bank is giving you 4% and inflation is 2% then your real return is 2%:

Well what do you know. The real rate of return is currently 1.65% – the same as the average under the Howard Government – and that average includes the now abnormally high returns left over from the high interest rates under Keating. If you look from 2000-2007 however, savers were being mightily screwed compared to now.

But it’s good to know Joe Hockey and Tony Abbott want that to return. Incidentally any self-funded retirees out there whinging about interest rates going down etc, please stop it. The past 2 years you have been doing very well. You cannot expect to always get a real return of 3.5% from just sticking your money in the bank and putting you feet up. Be realistic. 1.65% is about .5% better than you would have average over the past decade.

OK now to see mortgages compared to inflation. Again this looks at the real cost. If inflation is 2% and the bank charges you 7% that is a greater real cost to you than if inflation is 5% and the bank is still only charging you 7%:

Again we find that the real rate you are paying for your mortgage is less than the Howard Government average. Again that average includes the big rates coming down from the Keating Government, but Joe Hockey likes to cites the average mortgage rate during that time, so what’s good for the goose…

All up I think these graphs nicely show that yes life has changed sine the GFC with respect to mortgages and their relation to the cash rate, but that actually things aren’t that much different, and an argument could be made that they are better – for both borrowers and savers.

Also remember as well – the RBA knows this, and as I pointed out yesterday, if the spread of the mortgage to the cash rate was lower, then the RBA wouldn’t have needed to lower the cash rate by as much.

You're assuming the Bank's only source of income is represented by the difference in rates. You're forgetting a) Fees and Charges (ask Macquarie how lucrative these can be) and b) Reserve Assets ratio - nominally around 1.7 but, if US banks are anything to go by, actually vastly more. If ratio was,say, 2, then a deposit of $100 at 4% could be lent twice at, say, 6% returning $12/pa for cost of $4 - so 8% return - not 2%

ReplyDeleteAnon - yes, I'm not including fees because I'm not really looking at profit.

ReplyDeleteI'm not suggesting the banks aren't screwing us through fees, rather that they're not in terms of rates compared to the cash rate or compared to the deposit/mortgage rates.

Hi Greg,

ReplyDeleteI understand that in the market based banking system politicians have little or no influence on interest rates and your analysis is compelling, however, I can't figure this out for the life of me - I have graphed the RBA cash rate against the bank rate from 1990-2012 [http://goo.gl/GSFdd] and calculated the divergence (the disparity between the two). During the Howard-Costello years it's virtually a flat line. This would be understandable if rates were constantly rising, but this is not the case. As your graphs show, from 2000-2001 deposits drop, rates drop, yet the banks pass on the cuts to consumers wholesale. Fast forward to post-2007 and despite the effects of the GFC and the need for stimulus we see a considerable divergence between the cash rate and the bank rates. Why is it that under Howard the banks passed on the cuts even when deposits dropped? Could there be some truth in political clout? Hope you can illuminate this one for me.

ADDENDUM: I take your point, regarding the term deposit to cash rate, that "up until 2008, the rate for a 6 month term deposit was less than the cash rate. Now it is above it". But from 2007 to 2008 it is still at its lowest point, yet the disparity between the bank rate and the cash rate begins to change. Also, from 1990 to 1992 we see that the term deposit to cash rate is at a similar low, yet the disparity between the cash rate and the bank rate grows and fluctuates. It still does not fully explain the flat line from 1997 - 2007.

ReplyDeleteDaniel - basically the banks cut the whole rate because they could afford to and because they had to. Back then they weren't fighting hard to get deposits, they were fighting hard to get mortgages.

ReplyDeleteBack then they only got about 40% of their funds through deposits, now it's 50% - a significant increase, but more importantly the cheap money from overseas dried up.

Remember as well the banks during the heyday of the 90s-2002 were competing for mortgages against all those non-bank lenders who were getting cheap credit from overseas.

The GFC put an end to that. Firstly that credit disappeared - and you can see that the party was over on that score from the start of 2008 - and secondly those non-bank lenders disappeared as well.

As a result funding costs went up and the banking competition went down. Prior to 2008 the top 4 banks held around 80% of all mortgages. Now they hold 90% - the jump from 80 to 90 occurred in about 12 months - and at that time the spread of mortgages to the cash rate increased almost at the exact same pace (I wrote about that Link here ).

So the increase is a result purely due to finance conditions - both costs and competition. The big "political" issue with the rising costs is that during the GFC Wayne Swan approved the merger of Westpac and St George, which regardless of "strict conditions" did reduce competition.

I think (perhaps incorrectly) that Daniel is making a broader point, and despite all the data, he is probably right. Time will tell.

ReplyDeleteAnd despite all the data and spiffy graphs in this post, there is still no explanation for why the electorate have long been suckered into believing that a mortgage during the Hawke/Keating era (ah, bless) was hideously more difficult to finance than during the long and lost years of Howard.

Some spin sticks, and keeps on sticking.

Perhaps in the way that banks have suddenly got a whole bunch of excuses for not passing on rate cuts to their mortgage holders. Australian banks have never been more stable or more profitable.

It will be interesting to see how things unfold with interest rates under the next Liberal Gov't, and how the banks respond. Tick tock, tick tock.