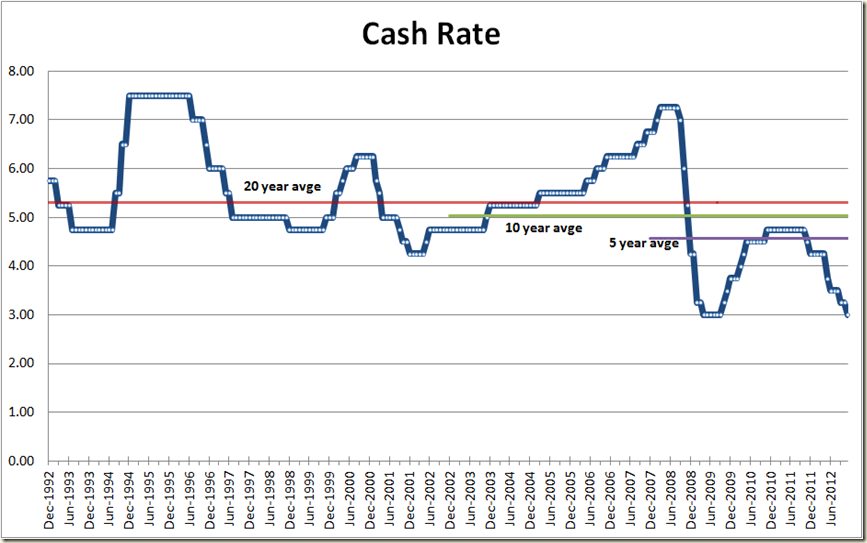

Today the RBA announced that it was cutting the cash rate by 25 basis points from 3.25% to 3.0%.

This now puts the cash rate at the equal record lowest level.

The cut was largely expected – so expected that this is the impact it had on the exchange rate:

The rate cut actually saw the exchange rate rise! Seriously, the Aussie dollar is absolutely bullet proof at the moment. Have a look at the comparison of the cash rate with the Trade Weighted Index over the past decade:

The cash rate falls are having no impact on bringing down the exchange rate and at best are perhaps only stopping it from rising more. This is really unprecedented in the post-float world.

Now the word thrown around will be “emergency levels” because the cash rate is now at the same level as it was in the GFC.

Well yes it is, but there are a couple big differences.

- Firstly, when the cash rate last reached 3.0% Australia’s annual GDP growth was 0.8%, the latest national accounts are out tomorrow and the GDP annual growth is likely to be around 2.7-3.0%.

- Secondly, back then the Government was implementing a historically large budget stimulus spend. This time round the Government is undergoing a historically large budget contraction:

What happened back then was that both the Government and the RBA were working to stimulate the economy; now only the RBA is doing it. Had the Government back in 2009 not spent so much on stimulus (as the Liberal Party suggested) it is likely the RBA would have had to lower the cash rate to around 1.5% to compensate. You can debate whether or not that would have been a better way to avoid the GFC (I don’t think it would have – I think it would have almost certainly led to a recession), but you can’t look at fiscal and monetary policy and suggest that the reasons for a 3% cash rate now are the same as the cash rate of 3% in the GFC.

Unless of course you are Joe Hockey and you have to say something bad about the the decision, but then he has to stand by a leader who says such things as this only a month ago:

'”the trouble with a government which cannot get the Budget back into surplus is that it keeps putting more pressure on households because a government which is out there borrowing, in this case, $20 million a day, is always putting unnecessary upward pressure on interest rates…”

So why did the RBA drop the cash rate? Well one indicator (as you’ll see in my Drum piece tomorrow) job growth is pretty much non-existent and today the building approval data showed nothing joyful:

And then yesterday there was the retail sales figures:

Pretty limp.

Now of course the big issue is what will the banks do. If they follow the past few rate cuts and only pass on 20 of the 25 basis points well end up with this:

The standard variable mortgage will be around 6.45% – well below the 20 year average of 7.70%, and even the Howard Govt average of 7.26%.

But the small overdraft for businesses is likely to only fall to about 10.1% – still above the 20 years average of 9.84%.

This will all lead to the spread of the bank rates to the cash rate increasing to obscene levels:

Of course if the spread was narrower it is unlikely the RBA would have actually cut rates to as low as they have.

When we look at the percentage of disposable income spent on interest payments for housing mortgages we see that while the cash rate might be low, the amount spent servicing mortgages is not. Although the recent drops in the cash rate should get the percentage of disposable income spent on interest payment to below 8% for the first time since December 2004 (not including the GFC), and a long way below the 11.1% it accounted for in December 2008:

Now to the RBA statement. Let’s do a quick comparison with this month and last month:

Global growth is forecast to be a little below average for a time. Risks to the outlook are still seen to be on the downside, largely as a result of the situation in Europe, though the uncertainty over the course of US fiscal policy is also weighing on sentiment at present. Recent data suggest that the US economy is recording moderate growth and that growth in China has stabilised. Around Asia generally, growth has been dampened by the more moderate Chinese expansion and the weakness in Europe.

The big change from last month is the addition of mention of the US fiscal cliff, otherwise there’s no change.

Key commodity prices for Australia remain significantly lower than earlier in the year, though trends have been more mixed over the past few months. The terms of trade have declined by about 15 per cent since the peak, to a level that is still historically high.

The difference is that in November the terms of trade decline was 13 per cent since the peak.

Sentiment in financial markets remains better than it was in mid year, in response to signs of progress in addressing Europe's financial problems, though Europe is likely to remain a source of instability for some time. Long-term interest rates faced by highly rated sovereigns, including Australia, remain at exceptionally low levels. Capital markets remain open to corporations and well-rated banks, and Australian banks have had no difficulty accessing funding, including on an unsecured basis. Borrowing conditions for large corporations are similarly attractive and share prices have risen since mid year.

No change except for a shift from “Financial markets have responded positively over the past few months…” to “Sentiment in financial markets remains better than it was in mid year”. Good luck working out if that is a positive or a negative!

In Australia, most indicators available for this meeting suggest that growth has been running close to trend over the past year, led by very large increases in capital spending in the resources sector, while some other sectors have experienced weaker conditions. Looking ahead, recent data confirm that the peak in resource investment is approaching. As it does, there will be more scope for some other areas of demand to strengthen.

Again, no change except for the inclusion of “while some other sectors have experienced weaker conditions”. Hardly a stunning statement.

Private consumption spending is expected to grow, but a return to the very strong growth of some years ago is unlikely. Available information suggests that the near-term outlook for non-residential building investment, and investment generally outside the resources sector, remains relatively subdued. Public spending is forecast to be constrained. On the other hand, there are indications of a prospective improvement in dwelling investment, with dwelling prices moving a little higher, rental yields increasing and building approvals having turned up.

Hardly any difference to what they said in November. A bit of different wordage, but not of meaning. Also just note “Public spending is forecast to be constrained”, which doesn’t really match the wasteful and spendthrift ALP line that the LNP would have you believe.

Now to inflation:

Inflation is consistent with the medium-term target, with underlying measures at around 2½ per cent. The introduction of the carbon price affected consumer prices in the September quarter, and there could be some further small effects over the next couple of quarters. Partly as a result of that, headline CPI inflation will rise above 3 per cent briefly. Looking further ahead, with the labour market softening somewhat and unemployment edging higher, conditions are working to contain pressure on labour costs. A continuation of moderate wage outcomes and improved productivity performance will be needed to keep inflation low, since the effects on prices of the earlier exchange rate appreciation are now waning. The Bank's assessment remains that inflation will be consistent with the target over the next one to two years.

The big difference here is that in November the RBA talked of higher than expected inflation figures. That now is gone. Clearly the RBA is untroubled by the inflationary impacts of the carbon price. And it certainly didn’t stop them from dropping rates.

And the conclusion:

Over the past year, monetary policy has become more accommodative. There are signs of easier conditions starting to have some of the expected effects, though the exchange rate remains higher than might have been expected, given the observed decline in export prices and the weaker global outlook. While the full effects of earlier measures are yet to be observed, the Board judged at today's meeting that a further easing in the stance of monetary policy was appropriate now. This will help to foster sustainable growth in demand and inflation outcomes consistent with the target over time.

Again little change with last month. Absent are mention of higher than expected inflation data and in November the RBA also noted

“Business demand for external funding has increased this year, the housing market has strengthened and share prices have risen in line with markets overseas.”

This month it is not so positive in its summation that it wanted to mention those aspects.

And so tomorrow the National Accounts come out and on Thursday the Labour Force data and we shall see how the decision to let monetary policy do all the heavy lifting is going.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.