Here was the big splash on the front page of The Oz yesterday:

Carbon tax to hurt more than ETS, warns energy sector

…miners said failure to deal effectively with the trade exposure of export industries could cut more than 23,500 forecast jobs to 2020 and threaten the resources boom.

In submissions obtained exclusively by The Australian, the Energy Supply Association of Australia warns that delays to an ETS "would only serve to increase investor uncertainty", while the Minerals Council of Australia warns that the hybrid approach as proposed "will result in substantial volatility in carbon prices and will compromise investment certainty".

The MCA said the design of the carbon pricing scheme threatened the resources boom and could cost the industry $30bn over the period to 2020, threatening an investment pipeline worth $140bn and contradicting the government's strategy of "maximising the opportunities of the Asian century".

The energy and mining submissions will add to growing pressure from the business community over the design of Labor's carbon pricing scheme.

There was more:

Miners say 23,000 jobs at risk

MINING companies have warned Julia Gillard the design of the carbon tax threatens the resources boom and could cut more than 23,500 jobs this decade.

The Minerals Council of Australia says the carbon pricing scheme's design could cost the industry $30 billion to 2020, "threatening an investment pipeline worth $140bn and directly contradicting the government's own strategy of maximising the opportunities of the Asian Century".

Well actually it was the same, but hey – why not bang out 2 articles for the price of one…

I wondered, given the MCA and various chairmen and CEOs of carbon heavy companies are predicting the end of life as we know it (including poor Whyalla being wiped of the face of the earth), how the share prices in these companies has been going since the announcement on 24 Feb by Gillard that a fixed carbon price (or carbon tax if you must), was being introduced.

If the carbon tax was a killer for the industry, logically you would expect that since that announcement, the share price in those companies would be gloom and doom – unless you think people will invest in a company even though they believe it will be pretty well trashed next year.

Firstly let’s have a look at who is most exposed:

The Vic Super Carbon Count 2009 report lists the most carbon heavy industries:

Metal and mining aren’t happy campers it would seem.

Incidentally Scope 1 and 2 are defined as this:

Scope 1: Direct Greenhouse Gas (GHG) emissions emitted from business activities such as fuel combustion, refrigerant use and industrial processes. For example, emissions from a gas boiler used for heating or process emissions released during iron and steel production.

Scope 2: Indirect emissions from purchased electricity.

OK. Let’s have a look at the top 10 carbon-spewing, GHG-emitting companies:

And how important are these 10?

10 companies accounted for 75% of the combined Scope 1 and 2 emissions in the Index

Ok, but there are other companies that are smaller but whose emissions are m0re intense – ie when compared to their revenue. These would no doubt be the most worried by a price on carbon. Here are the Top 15.

Only Alumina, BlueScope Steel and AGL Energy are in both the Top 10 biggest and the Top 15 most intense.

Right, let’s get on to the share prices. Each chart shows the performance of the company’s share price in the last 3 months (which is quite handy since the announcement on 24 Feb was just under 3 months ago). Let us have a look, and given the dire words in The Oz yesterday, I expect a full on carnage as we see evidence of investors fleeing these companies about to be slaughtered by Julia Gillard and Bob Brown.

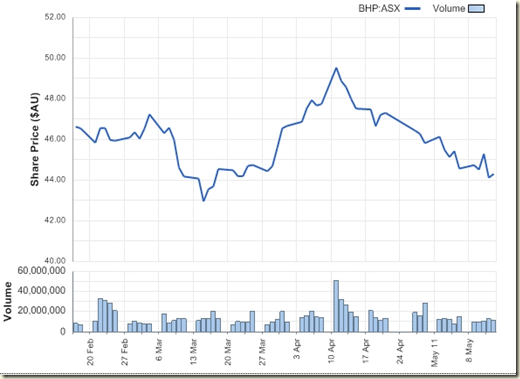

BHP

So around the time of the announcement it was trading at about $46 a share. Now it is $44. The only problem though is in the time since the Carbon Tax announcement the shares also went up to nearly $50 a share, and BHP has also announced it is continuing to expand its mining in Olympic Dam. How much is it spending on the project? Oh a lazy $20 billion or so. As a shareholder of BHP I sure as hell hope they know what they’re doing. Don’t they know the mining boom is about to be killed??

Just quickly (and I won’t do this for the others) you can see that BHP has been doing OK in the last 12 months despite Gillard also in that time announcing that the MRRT will continue.

RIO-TINTO

Like BHP, RIO’s share price is lower than it was when the carbon tax announcement was made, and like BHP it also went higher after the announcement. Hardly a sign of investors fleeing in distress.

BlueScope Steel

OK, here we have a company that has gone down and down since the announcement – from around $2 to 1.50. Must be the carbon tax. Err no:

BLUESCOPE STEEL has confirmed its earnings are being hit by the effects of the rising dollar, lower steel prices and weakness in demand in the domestic steel market.

there’s also this:

BlueScope has about $1 billion in debt. While its gearing is modest at about 14 per cent, some in the market had concerns about what the earnings pressures on the company could mean for its debt covenants.

And the carbon tax?

The company is a leading critic of the federal government's planned carbon tax and the impact it could have on the steel industry. But in the short-term, the spike in the dollar has been of greater concern.

Indeed analysts, JP Morgan, downgraded their outlook for BlueScope:

Analyst Benjamin Wilson said the cut was driven by a tough coming 12 months, including the high Australian dollar, BlueScope's falling share of the domestic market and uncertainty regarding the carbon tax.

The uncertainty of the carbon tax. Though not the actual carbon tax. (And incidentally at the same time JP Morgan upgraded their outlook for OneSteel).

Qantas

Hmmm. Not good numbers for Qantas. It was trading around $2.32 when Gillard made the announcement. Now it is $2.10 – a 9 per cent slide. Obviously the carbon tax?

Qantas Airway's pre-tax fiscal year profit could drop nearly 10 per cent as a result of the A380 engine fiasco that engulfed the company in late 2010, according to an analysis reported on by The Australian.

and:

Tough times have long been a recurring theme at Qantas and the latest round of challenges - rising oil prices, threats of industrial action and a string of mid-air emergencies last year - is nothing new.

…In terms of capacity, its latest half-yearly accounts indicate that Jetstar increased domestic capacity by 20 per cent and international capacity by 18 per cent. This pace is in contrast to Qantas, which expanded capacity by 3.3 per cent, with plans to increase it by 4.5 per cent.

Whatever surveys and customer service reports that Qantas brings up, mounting anecdotal evidence shows it has lost the mindshare of customers. The growing perception is Qantas doesn't care about safety, customer service or its employees.

So carbon tax? Nope. Oh and also once again:

The airline's chief noted: "Australia's Qantas Airways Ltd. (QAN.AU) faces an increasingly tough battle making its international flights profitable amid rising fuel costs, foreign competition and a surging Australian dollar that's hitting inbound tourism.

That high Aussie dollar…

AGL Energy

Now AGL Energy is in both the Top 10 carbon emitters, and also the Top 15 carbon intense companies. It’s share price was around $14.50. Now it’s around $14.50. Huh.

Wesfarmers

Wesfarmes is another whose price went down and then came up, and now sits around where it was when the announcement was made. I guess investors have concluded that the carbon tax won’t be introduced.

Alumina

Alumina is another in both the Top 10 biggest and Top 15 most intense. It has gone up and down. How does Don Morley, its Chairman feel about its share price?

THE price of alumina has jumped 28 per cent in the past year but is still too low, according to Alumina Limited.

The strong Australian dollar and higher energy prices were constraining its performance, the company said.

Margins for the commodity were tighter than they should be and its price did not reflect the cost and economics of producing and selling it, chairman Don Morley said.

China had been able to increase alumina and aluminium production to meet demand, which had limited price increases.

"This has limited aluminium price increases and meant that aluminium has underperformed relative to other commodities," Mr Morley told shareholders at Alumina's annual meeting.

And the carbon tax?

Mr Morley attacked the proposed carbon tax, saying China's alumina and aluminium industries did not pay a similar tax and would shift production away from Australia if one was introduced here.

So he doesn't want it, but even he doesn’t suggest it is constraining their performance. (But yeah that strong Australian dollar…)

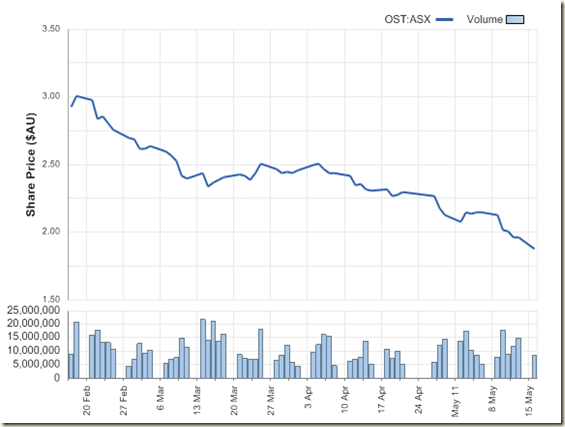

Onesteel

Not good signs for One Steel. A steady decline. Bloody Gillard and Bob Brown – there’s your proof! Oh wait:

IN a sign of mounting pressure facing the nation's manufacturers, OneSteel has slashed second-half profit guidance by a quarter because of a high dollar and wet weather in South Australia, sending its already battered share price to a fresh two-year low.

Wet weather? High dollar? That’s not quite on the script where hearing.

Orica

Well it was trading around $25.50 and now it is around $26.50. A horror story, I know. Close your eyes and just keep reading, maybe it’ll all go away if we pretend we didn’t see it.

Boral

The evidence here is pretty overwhelming…

Building materials supplier says it remains on track to deliver a turnaround in annual net profit, despite soft residential markets and bad weather earlier in the year.

Again with the bad weather and local demand.

OK, look, these are just isolated examples… let’s move onto the Carbon Intense companies, there we’re sure to see the Carbon Tax at work:

Energy World

Ummm….

Adelaide Brighton

Adelaide Brighton’s share price certainly has gone down. Though again at the time of the announcement they were around $3.30, but in April they rose to $3.35, so the price fall is certainly not due to any carbon price announcement. They too would have been affected like Boral and OneSteel by bad weather and falling demand (oh and yeah, the strong Australian dollar).

Paladin Energy

Ouch. Look at that fall! And it came just a little bit after Julia Gillard put the knife into the mining industry. Quod erat demonstrandum.

Thing is, Paladin Energy is in uranium mining. What event happened on 11 March that may have seen a fall in the share price of companies whose main revenue is uranium? Yep the tsunami and subsequent Fukishima Plant 1 “issues”:

However, the shallow 9.0 Tohoku earthquake on 11 March 2011 off the coast of Japan caused significant accidents at four nuclear power plants in Japan with the release of radioactive material from the Fukushima I Power Plant.

Paladin addressed the issue in the company’s recent quarterly report reminding readers that “nuclear power still has an impressive safety record when judged alongside other energy sources.”

Uranium prices fell sharply after the earthquake.

So carbon price? Sorry nothing to see here, move on.

Santos

So after the announcement Santos share price went up, then down to about where it was. Why?

SANTOS has told shareholders to get used to lower dividends for the next five years, as it prepares to spend more on its plans to become a substantial liquefied natural gas producer.

At the meeting, chief executive David Knox brushed off questions about a dinner at Kirribilli House on Wednesday night to discuss Julia Gillard's planned carbon tax.

Instead, he restated the company's position that a carbon price was needed, but that industries exposed to overseas competition, such as LNG, should be compensated.

How much is it planning on spending on LNG production?

In January, Santos and its joint-venture partners started construction of the $16 billion Gladstone LNG project, which is planning to export onshore coal-seam gas to Asia from 2015.

Has this project been suspended since the announcement on February 24? That’d be a no.

Look I know share prices can be influenced by numberless things. I know BHP, Rio etc have operations overseas. But the next time you hear some mining company talking head or paid spin doctor going on about the destruction of the industry, the end of the boom, the death of Whyalla, or Tony Abbott saying the carbon tax will kill the mining industry “stone dead”, ask yourself, if that were true would you be investing in companies likely to heavily affected by a carbon price (and indeed a mining tax) if it was your job to make money from investing on the share market?

Investors in the market may be cocky and arrogant and brash. But they’re not stupid. They’re not investing in these companies on the assumption that the carbon tax or the mining tax won’t get passed. They’ve factored it in and and still investing in them.

A 5 per cent appreciation in the exchange rate, is the equivalent to a price reduction (or cost increase) of $30 per tonne in Australian dollar terms. The $A has appreciated by 7.5 per cent so far in 2011 and by almost 57 per cent since the beginning of 2009. These effects are multiples larger than any potential impact from a carbon price

So a 5 per cent rise in the dollar is like $30 per tonne price on carbon. The graph on the left shows the percentage increase in the value of the dollar since the start of 2009. 5 per cent happened a long time ago. Has the mining, manufacturing, cement industries been destroyed? Is Whyalla still here? Even a $40 per tonne price that is being bandied around or the $49 per tonne price that is being suggested will be in place once the ETS begins, will not be as big an impact as the increase in the dollar over the last 12 months.

Look there will be job losses from a price on carbon. It will not be great for everyone. But let’s get some perspective – there are things happening in the economy and in industries that have had bigger impacts than a price on carbon and yet Armageddon has been avoided.

So when you read that the end of times is coming. Take a deep breath and ask why has BHP share price increased about 22 per cent over the last 12 months? Because it sure as hell ain’t because Tony Abbott says he will wind back the tax in 2013.

And just on the rise of the Australian dollar which has hurt so many companies like BlueScope and Qantas, Matt Cowgill last year pointed out that the Treasury had already thought of a policy that would help out downward pressure on the dollar:

Their solution was a resource rent tax that would flatten out the disparities in our two-speed economy and put downward pressure on the exchange rate (particularly if some of the revenue was invested off shore).

Now if only that had been introduced….

18 comments:

Needs more graphs.

Damn it Greg. You're spoiling a perfectly good beat up with far too many facts and figures.

Plus, it's obvious you've been hanging around with that other well known graph addict Possum Comitatus.

Otherwise....It's a bloody good read. :-)

lolz Red. Yeah I know a bit over the top. (a bit??!)

Good analysis. Point nicely driven home by pretty graphs. The high dollar is far more dangerous to our economy than another tax. But the high dollar looks like we are winning!!!! And the carbon tax is another great big tax. Sigh. Success sells.

Grog,

I wonder if an overlay of the ASX200's progress during the period would be illuminating?

I don't know what it would reveal, but a testable hypothesis would be that if the mining and metals industries are on the point of collapse, the punters would be shifting into less carbon intensive stocks. This should be reflected in the companies in your illustration doing worse than the weighted average of the market.

Alternatively, given the dominance in the share market of several of the major companies you have identified, why aren't the punters rushing for the exits and moving into property? Except that they aren't!

PF

I'm with paddybts, why let the facts get in the way of a good beat up. When you have economic illiterates commenting on economic policy in the MSM (Boltemetrics anyone?), we shouldn't really be surprised.

Surely at some point the public will cotton on to the chicken little effect here. Clearly the sky is not falling. Or am I being naive(and too hopefull)?

PF - I did want to do that, but couldn't work out how to do it! The ASX graphs have it, but they're ugly. I was using the graphs created on news.com.au

Wow. I'm glad I didn't hold my breath at the start of that post, Grog.

Anyway, I guess we need to keep our eyes peeled for future profit warnings from these carbon-heavy companies, hey?

Can't have the corporate/market regulators coming down like the proverbial ton for misleading the investors, can we? ^^sarcasm

In the past year, May 2010 to April 2011, the total return from the S&P/ASX-100 index was 4.4%, compared with a total return of 15.5% from the S&P/ASX-100 resources index.

Furthermore, anyone who adjusts their investment strategy based on 3-month returns on a couple of mining stocks isn't an investor, they're a speculator.

If you have a diversified portfolio, you're picking up gains in renewable energy stocks anyway.

It's funny how the capitalists turn into socialists, wanting the government to under-write their concentrated 'investment' strategies when things change.

Mr. D,

I'm pretty sure that it was Kim Beazley the elder, who first coined that extremely apposite phrase about those who want to capitalise their profits and socialise their losses. Iirc, Kim was referring to the Country Party, but it applies very widely throughout business, and of course also to some "victims" of finance scams. Risk-takers indeed!

PF

Grog, how can you pull together all this information and analysis (sure, you did outdo yourself this time on the graph front) when it seems to be completely beyond the mainstream paid (hmmm, could be something in that word) journalists to do the same?

The $$ is whacking all of us who export goods or services. The carbon tax, by and large, will be absorbed. When the dollar goes back down, I look forward to the headlines "Life much cheaper under the carbon tax".

Dream on, I know.

Greg, this is a small quibble, I hope:

your quote regarding the steel industry seems to be equating a 5% movement in the exchange rate with a $30 movement in the price for a tonne of steel, not CO2-equivalent. You seem to have read it as CO2E - which is it?

Otherwise, thanks, loved it.

Expect pretty much the same sort of reaction to Joe Hockey's "Budget Reply" speech at The Press Club today. His performance was pathetic to say the least. The gaps in the Coalitions' understanding of economics just keeps getting bigger. I guarantee that very little will be reported on the way the questions asked were ignored, or overrun with bluster, and in the case of Andrew Probyn's (from The West Australian) question fobbed off with insinuation it was a Labor plant followed up by an outright lie (inferring that there had been no questioning of the Coalition "black hole" in their pre-election economic statement.

Peter Martin (The Age) tried to get an answer later but was responded to with bluster. When he persisted with further attempts to get some concrete response, the Chairman (Steve Lewis "The Australian") called the meeting "at end". Obviously Steve is a fan of "Saving Private Ryan" in his attempt to save private Joe from further questioning.

P.S. Joe used lots of charts also but his were not filled with quality information like yours - in fact each chart represented another facet of the "smoke and mirrors" circuses favoured by the Coalition.

Greg, this seems an appropriate moment to mention that I LOVE YOUR WORK. Thank you!

Great article! Just a presentation question - Could you make it punchier by starting with a summary para of your main point, rather than burying it after a long couple of quotes from the oz? Just a line about share prices and one about the rising dollar NOT demolishing whyalla for example, could do it.

Awesome. All this on top of reading Sideshow.

As someone said earlier, you were equating one tonne of steel production to one tonne of CO2 output - after a quick bit of googling it looks like the ratio is actually about 2 tonnes of CO2 per tonne of steel, which makes a significant impact to the numbers you used in your argument, but not to the overall results.

Bunch of whinging CEOs . . .

Post a Comment