Today the RBA announced that it was keeping the cash rate steady at 3%

This is what the cash rate looks like over the past 20 years:

As you can see form the 5 years average we’re in pretty new territory. I can’t imagine what the cash rate at the 7.25% that it was in early 2008 would do to the economy now. The only way we would get back to that level is if the banks closed the margins between the cash rate and their interest rates. For while the cash rate is well below the 20 year average, the standard mortgage low is below it, but by a fair bit less than is the cash rate. The small business loan on the other hand is pretty much right on the 20 year average

That leads to these spreads:

All of which looks horrible, but as readers of this blog would know, there’s a bit more to bank financing than the spread of the cash rate to the mortgage rate.

Take the spread of the cash rate to the term deposit rate:

After 12 years of the term deposit for $10,000 for 6 months being LESS than the cash rate, it is now (assuming the banks don’t adjust their rates after today’s decision) it is 85 basis points ABOVE the cash rate.

Savers rarely get a mention when talking about the cash rate. They should.

Similarly compare the spread between the deposit rate and the mortgage rate:

And what we discover is that the mortgage rate is actually closer to the deposit rate than it was for the average of the Howard years – meaning if you want to get to the Howard Government average, either mortgage rates have to go up, or deposit rates have to go down.

Anyhoo let’s look at the statement, and compare it with March’s:

First GLOBAL CONDITIONS

Global growth is forecast to be a little below average for a time, but the downside risks appear to have lessened over recent months. The United States is experiencing a moderate expansion and financial strains in Europe are considerably reduced compared with the situation through much of last year. Growth in China has stabilised at a fairly robust pace. Around Asia generally, growth was dampened by the earlier slowing in China and the weakness in Europe, but again there are signs of stabilisation. Commodity prices are little changed recently, at reasonably high levels.

Now April:

Global growth is forecast to be a little below average for a time, but the downside risks appear to be reduced. While Europe remains in recession, the United States is experiencing a moderate expansion and growth in China has stabilised at a fairly robust pace. Around Asia generally, growth was dampened by the earlier slowing in China and the weakness in Europe, but again there are signs of stabilisation. Commodity prices have declined somewhat recently, but are still at historically high levels.

The big difference is the downside risk have gone from “lessened” to “reduced”. OK, maybe that’s not a big difference. But certainly in April the RBA is more negative towards Europe, stating it is in a recessions, rather than saying in March that the financial strains there are reduced from this time last year. The rest is basically a cut and paste.

Next, FINANCIAL MARKETS

March:

Sentiment in financial markets is much improved compared with the middle of last year. Risk spreads have narrowed and funding conditions for financial institutions are more favourable. Long-term interest rates faced by highly rated sovereigns, including Australia, remain at exceptionally low levels. Borrowing conditions for large corporations are very attractive. Share prices have risen substantially from their low points. However, the task of putting private and public finances on sustainable paths in several major countries is far from complete. Accordingly, as seen most recently in Europe, financial markets remain vulnerable to occasional setbacks.

April:

Internationally, financial conditions are very accommodative. Risk spreads are narrow and funding conditions for financial institutions have improved. Long-term interest rates faced by highly rated sovereigns, including Australia, remain at exceptionally low levels. Borrowing conditions for large corporations are similarly very attractive. Share prices are substantially above their low points. However, the task of putting private and public finances on sustainable paths in several major countries is far from complete. Accordingly, financial markets remain vulnerable to setbacks.

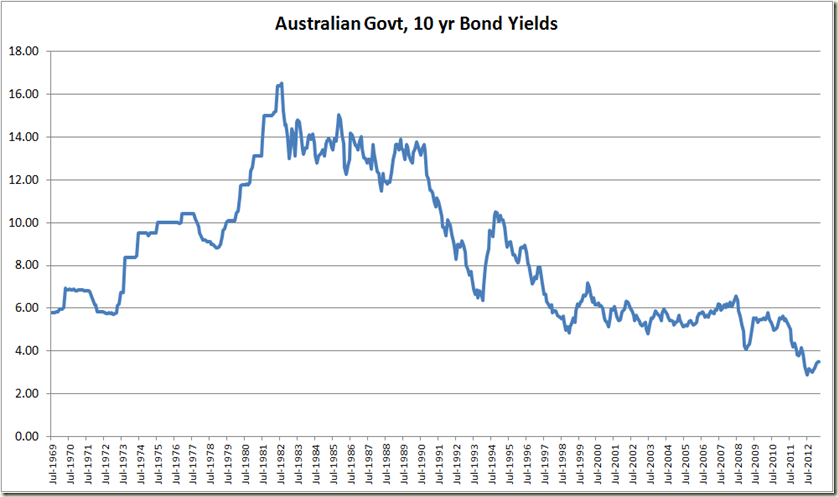

Geez, they really go in hard on the Australian Govt debt and how it is crowding out lending for corporations. Oh wait, sorry that was in the fantasy version of the statement written by the Liberal Party economic team. Note the aspect about “highly rated sovereigns”, and our historically low debt. How low?

Real low.

Next, DOMESTIC CONDITIONS:

March:

In Australia, most indicators available for this meeting suggest that growth was close to trend over 2012, led by very large increases in capital spending in the resources sector, while some other sectors experienced weaker conditions. Looking ahead, the peak in resource investment is approaching. As it does, there will be more scope for some other areas of demand to strengthen.

April:

In Australia, growth was close to trend over 2012, led by very large increases in capital spending in the resources sector, while some other sectors experienced weaker conditions. Looking ahead, the peak in resource investment is drawing close. There will, therefore, be more scope for some other areas of demand to strengthen.

Not much change other than the resources peak is now “drawing to a close” rather than the end of the peak “approaching”. We should note, “peak” doesn’t mean end of mining.

Onto DOMESTIC SPENDING:

March:

Present indications are that moderate growth in private consumption spending is occurring, though a return to the very strong growth of some years ago is unlikely. The near-term outlook for non-residential building investment, and investment generally outside the resources sector, is relatively subdued, though recent data suggest some prospect of a modest increase during next financial year. Dwelling investment appears to be slowly increasing, with higher dwelling prices and rental yields. Exports of natural resources have been strengthening, though recent bad weather is affecting some shipments at present. Public spending, in contrast, is forecast to be constrained.

April:

Recent information suggests that moderate growth in private consumption spending is occurring, though a return to the very strong growth of some years ago is unlikely. While the near-term outlook for investment outside the resources sector is relatively subdued, a modest increase is likely to begin over the next year. Dwelling investment is slowly increasing, with rising dwelling prices and high rental yields. Exports of natural resources are strengthening. Public spending, in contrast, is forecast to be constrained.

Again hardly any change. Of note for those who know for a fact that spending under this government is out of control: “Public spending, in contrast, is forecast to be constrained”.

INFLATION:

March:

Inflation is consistent with the medium-term target, with both headline CPI and underlying measures at around 2¼ per cent on the latest reading. Looking ahead, with the labour market softening somewhat and unemployment edging higher, conditions are working to contain pressure on labour costs, as was confirmed in the most recent data. Moreover, businesses are focusing on lifting efficiency under conditions of moderate demand growth. These trends should help to keep inflation low, even as the effects on prices of the earlier exchange rate appreciation wane. The Bank's assessment remains that inflation will be consistent with the target over the next one to two years.

April:

Inflation is consistent with the medium-term target, with both headline CPI and underlying measures at around 2¼ per cent on the latest reading. Labour costs remain contained and businesses are focusing on lifting efficiency. These trends should help to keep inflation low, even as the effects on prices of the earlier exchange rate appreciation wane. The Bank's assessment remains that inflation will be consistent with the target over the next one to two years

In March there was an ever so slight worry about pressure on labour costs. IN April is becomes “labour costs remain contained”. It’s like watching Beckett’s tragically much ignored play, “Waiting for Wages Breakout”.

MONETARY POLICY:

March:

During 2012, there was a significant easing in monetary policy. Though the full impact of this will still take more time to become apparent, there are signs that the easier conditions are having some of the expected effects. On the other hand, the exchange rate remains higher than might have been expected, given the observed decline in export prices, and the demand for credit is low, as some households and firms continue to seek lower debt levels.

April:

There are a number of indications that the substantial easing of monetary policy during late 2011 and 2012 is having an expansionary effect on the economy. Further such effects can be expected to emerge over time. On the other hand, the exchange rate, which has risen recently, remains higher than might have been expected, given the observed decline in export prices. The demand for credit has also remained low thus far, as some households and firms continue to seek lower debt levels.

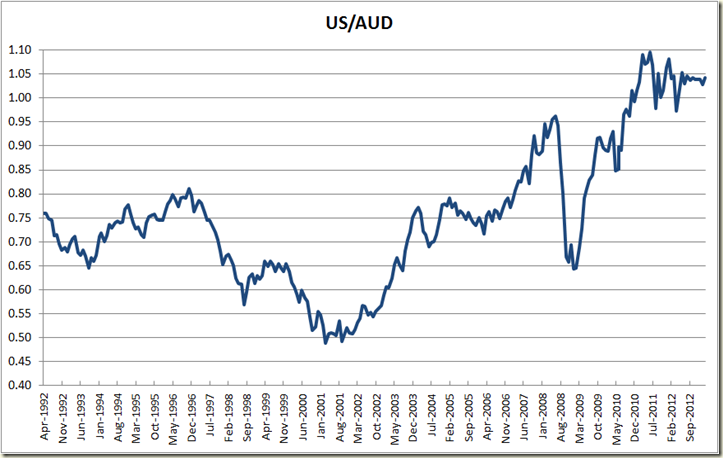

This month the RBA is really let everyone know that the easing of monetary policy is working – ie in their view to the extent no more easing is required. But they also notice that people aren’t borrowing all that much more than they were prior to the easing and that the exchange rate remains high despite easing of commodity prices. How high?

It’s times like this I like to recall the only time I have had a holiday in America was in June 2001.

CONCLUSION:

March:

The Board's view is that with inflation likely to be consistent with the target, and with growth likely to be a little below trend over the coming year, an accommodative stance of monetary policy is appropriate. The inflation outlook, as assessed at present, would afford scope to ease policy further, should that be necessary to support demand. At today's meeting, the Board judged that it was prudent to leave the cash rate unchanged. The Board will continue to assess the outlook and adjust policy as needed to foster sustainable growth in demand and inflation outcomes consistent with the target over time.

April:

The Board's view is that with inflation likely to be consistent with the target, and with growth likely to be a little below trend over the coming year, an accommodative stance of monetary policy is appropriate. The inflation outlook, as assessed at present, would afford scope to ease policy further, should that be necessary to support demand. At today's meeting, taking into account the flow of recent information and noting that there had been a substantial easing of policy as a result of previous decisions, the Board judged that it was prudent to leave the cash rate unchanged. The Board will continue to assess the outlook and adjust policy as needed to foster sustainable growth in demand and inflation outcomes consistent with the target over time.

The only difference was the addition of this in today’s statement: “taking into account the flow of recent information and noting that there had been a substantial easing of policy as a result of previous decisions”.

All in all the RBA paints a pretty good picture. Inflation steady, growth doing OK, wages steady, but with the dollar high. It wasn’t surprising that they didn’t move, given last month's big jump in employment numbers. But given everyone expects that to be revised down, and perhaps lead to an increase in the unemployment rate (although this is less sure, given the statistical changes by the ABS affect more the employment and participation numbers than the unemployment rate), it’ll be interesting to see if that changes their outlook.

On the basis of today’s statement though, I doubt it.

2 comments:

but but but but...aren't interest rates always going to be lower under a liberal government??

Clearly the Member for Goldstein, A. Robb, has failed to read, or does not believe, any RBA reports, because he still continually claims Australia is a sovereign risk!

Meanwhile, the Member for Warringah (the Leader of the Opposition) asked the Prime Minister the following supplementary question in the House of Representatives (my emphasis):

“In what year will Labor's run of deficits finally end, given that the global financial crisis actually ended almost four years ago?”

(Hansard, Wednesday, 20 March, 2013)

Next day, the same Member said in the House of Representatives:

“We know that these are difficult times for our country. There is a continuing economic crisis in much of Europe.”

(Hansard, Thursday, 21 March, 2013)

So, according to the Member for Warringah, there is not a continuing economic crisis and there is a continuing economic crisis!

Exactly which economic crisis does the Opposition think is continuing in Europe?

Or does the Member for Warringah think that Europe is not part of the globe and that the crisis is over for the USA and the global financial world? His economics degree has proved invaluable. What a great leader he will make; he is a decisive politician, consistent in his theories!

The Coalition are reminiscent of “The Dreamfixer” in an episode of “Hustle” (shown on ABC1). The Coalition's amorphous economic policy and its nebulous statements are similar, promising to satisfy just about everyone's dreams. Beware the dictum of the “Dreamfixer”, espoused when he left his supporter with nothing: “The scenery only changes for the lead dog.”

Post a Comment