My Drum piece this week looked at the exchange rate and how it really is a bugger of a thing to predict – especially when you try and apply economic principles to it.

Given it has only got 64 comments, I’m guessing the exchange rate is not the most fiery of issues to debate. Ahh well. When I was studying economics at uni back during the 1990s recession one of my favourite subjects was “International Trade and Finance”, mostly I think because the textbook we used had a chapter titled “Offshore Banking and International Money Laundering”. Who says you don’t learn anything practical at uni? Perhaps I should have written about that…

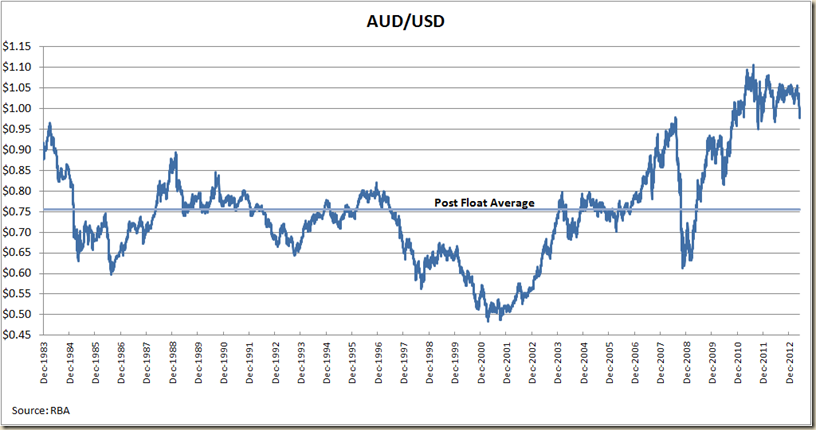

Anyhoo the dollar does bizarre things. Since the float of the dollar the average value has been US$0.7554, but during this century other than the 12 months of 2005 it has either been well below it (great for exporters) or since 2007 for the most part well above it (great for people who like buying imported things) and significantly above it since the end of 2010.

And going back to the start of the float the picture is this:

But of course we don’t only trade with the US, so we can look at the Trade Weighted Index. Since the float it had average 60.9, and currently it sits at 74.9.But if we go back before the float and look at the TWI since 1970 a different picture emerges:

The average back to 1970 is 71.8.

During 1973-74 the Aussie dollar was actually worth US$1.4875. Such a rate now would pretty much kill the economy (and certainly didn’t help it back then).

But while the TWI is one version of an effective exchange rate, the Bank of International Settlements does it's own version, and it goes back to 1964. On its measure, the Australian dollar is almost as high as it has ever been:

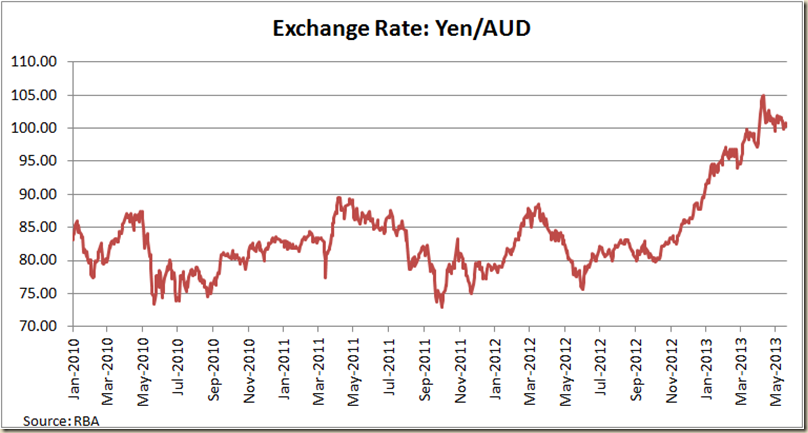

Anyway, at this level it starts getting a bit academic. The general consensus is the dollar is too high, but it’ll probably take the rest of the world to get back in shape before it starts going down – and even then, it depends how the rest of the world goes about doing it. If opther coutnires follow the “Abenomics” line of Japan we’ll stay high for a while:

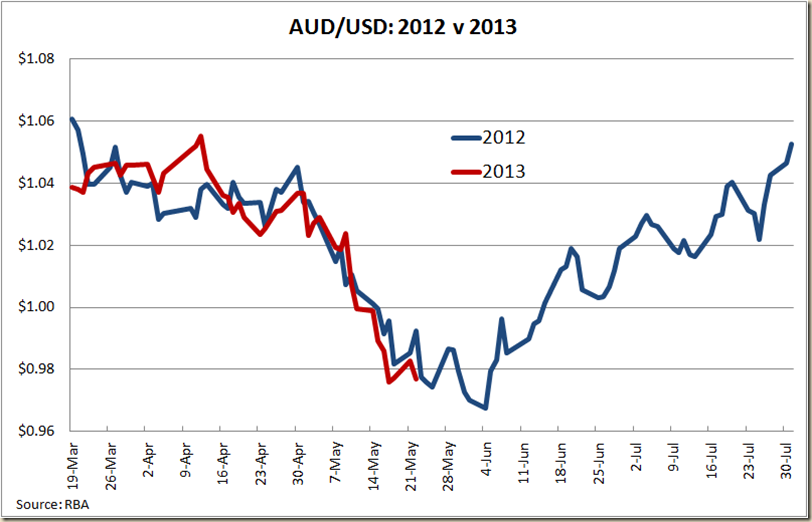

And the updated graph of 2012 versus 2013 shows the spooky similarity still occurs. We wait for Ben Bernanke to give us his tea leaves tonight…

1 comment:

IN again.

Post a Comment